- Malaysia

- /

- Medical Equipment

- /

- KLSE:TOPGLOV

A Rising Share Price Has Us Looking Closely At Top Glove Corporation Bhd.'s (KLSE:TOPGLOV) P/E Ratio

Top Glove Corporation Bhd (KLSE:TOPGLOV) shares have continued recent momentum with a 63% gain in the last month alone. Zooming out, the annual gain of 237% knocks our socks off.

All else being equal, a sharp share price increase should make a stock less attractive to potential investors. While the market sentiment towards a stock is very changeable, in the long run, the share price will tend to move in the same direction as earnings per share. The implication here is that deep value investors might steer clear when expectations of a company are too high. One way to gauge market expectations of a stock is to look at its Price to Earnings Ratio (PE Ratio). A high P/E ratio means that investors have a high expectation about future growth, while a low P/E ratio means they have low expectations about future growth.

See our latest analysis for Top Glove Corporation Bhd

How Does Top Glove Corporation Bhd's P/E Ratio Compare To Its Peers?

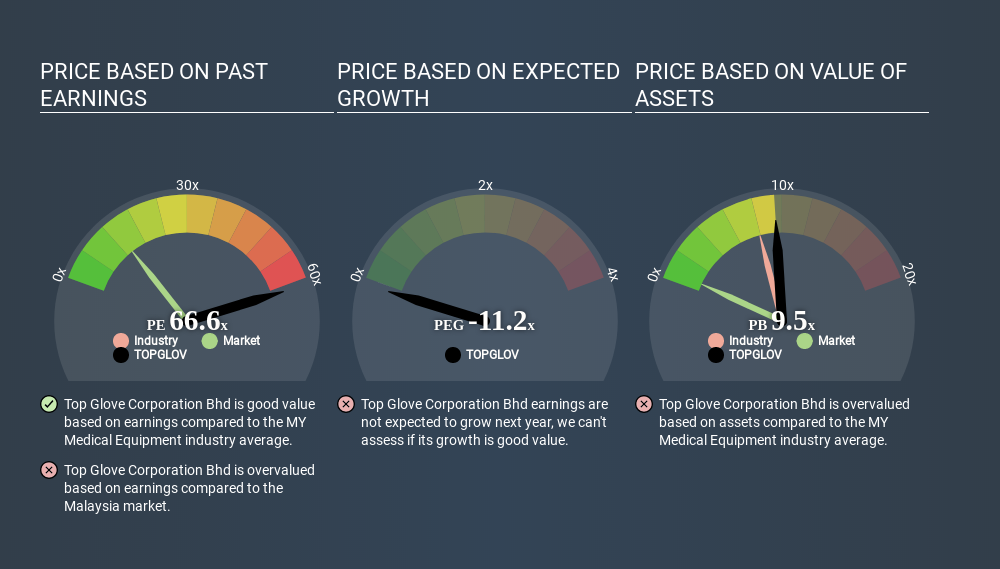

Top Glove Corporation Bhd's P/E is 66.63. As you can see below Top Glove Corporation Bhd has a P/E ratio that is fairly close for the average for the medical equipment industry, which is 66.6.

That indicates that the market expects Top Glove Corporation Bhd will perform roughly in line with other companies in its industry. The company could surprise by performing better than average, in the future. Checking factors such as director buying and selling. could help you form your own view on if that will happen.

How Growth Rates Impact P/E Ratios

Probably the most important factor in determining what P/E a company trades on is the earnings growth. When earnings grow, the 'E' increases, over time. And in that case, the P/E ratio itself will drop rather quickly. So while a stock may look expensive based on past earnings, it could be cheap based on future earnings.

In the last year, Top Glove Corporation Bhd grew EPS like Taylor Swift grew her fan base back in 2010; the 67% gain was both fast and well deserved. The sweetener is that the annual five year growth rate of 24% is also impressive. With that kind of growth rate we would generally expect a high P/E ratio.

A Limitation: P/E Ratios Ignore Debt and Cash In The Bank

One drawback of using a P/E ratio is that it considers market capitalization, but not the balance sheet. In other words, it does not consider any debt or cash that the company may have on the balance sheet. The exact same company would hypothetically deserve a higher P/E ratio if it had a strong balance sheet, than if it had a weak one with lots of debt, because a cashed up company can spend on growth.

Such expenditure might be good or bad, in the long term, but the point here is that the balance sheet is not reflected by this ratio.

Is Debt Impacting Top Glove Corporation Bhd's P/E?

Top Glove Corporation Bhd has net cash of RM284m. That should lead to a higher P/E than if it did have debt, because its strong balance sheets gives it more options.

The Bottom Line On Top Glove Corporation Bhd's P/E Ratio

With a P/E ratio of 66.6, Top Glove Corporation Bhd is expected to grow earnings very strongly in the years to come. Its net cash position is the cherry on top of its superb EPS growth. To us, this is the sort of company that we would expect to carry an above average price tag (relative to earnings). What is very clear is that the market has become significantly more optimistic about Top Glove Corporation Bhd over the last month, with the P/E ratio rising from 40.9 back then to 66.6 today. If you like to buy stocks that have recently impressed the market, then this one might be a candidate; but if you prefer to invest when there is 'blood in the streets', then you may feel the opportunity has passed.

Investors should be looking to buy stocks that the market is wrong about. People often underestimate remarkable growth -- so investors can make money when fast growth is not fully appreciated. So this free report on the analyst consensus forecasts could help you make a master move on this stock.

But note: Top Glove Corporation Bhd may not be the best stock to buy. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20).

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About KLSE:TOPGLOV

Top Glove Corporation Bhd

An investment holding company, manufactures, trades in, and sells gloves in Malaysia, Thailand, the People’s Republic of China, and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.