- Malaysia

- /

- Metals and Mining

- /

- KLSE:PMETAL

3 High Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

In a week marked by solid gains in global markets and a rebound in U.S. stocks, growth companies have particularly shone, driven by strong performances from technology stocks. As investors navigate these volatile times, identifying high-growth stocks with substantial insider ownership can offer insights into potential long-term value. When evaluating such opportunities, it's important to consider not only the company's growth trajectory but also the confidence that insiders—those who know the business best—have demonstrated through their significant ownership stakes.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 20.6% |

| People & Technology (KOSDAQ:A137400) | 16.5% | 35.6% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.5% | 52.1% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.1% | 95% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

We'll examine a selection from our screener results.

Press Metal Aluminium Holdings Berhad (KLSE:PMETAL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Press Metal Aluminium Holdings Berhad, with a market cap of MYR39.39 billion, is involved in the manufacturing and trading of aluminum as well as smelting and extrusion products across Malaysia, other Asian countries, Europe, Oceania, and internationally.

Operations: The company's revenue segments include manufacturing and trading of aluminum, as well as smelting and extrusion products across Malaysia, other Asian countries, Europe, Oceania, and internationally.

Insider Ownership: 23.1%

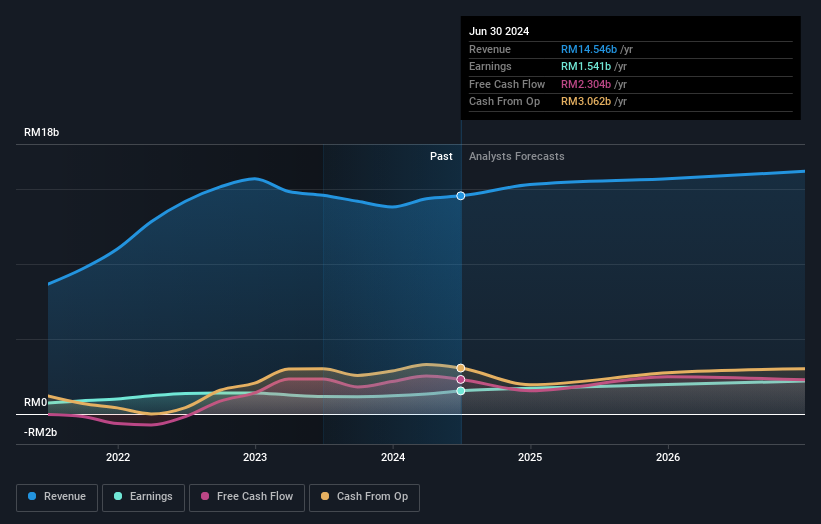

Press Metal Aluminium Holdings Berhad has demonstrated solid growth, with recent earnings showing a net income of MYR 505.83 million for Q2 2024, up from MYR 305.79 million a year ago. The company’s collaboration with Xi'an Jiaotong University on carbon capture technologies underscores its commitment to sustainability and innovation. Insider ownership remains high, aligning management interests with shareholders and supporting forecasted earnings growth of 15.6% annually, outpacing the Malaysian market average.

- Unlock comprehensive insights into our analysis of Press Metal Aluminium Holdings Berhad stock in this growth report.

- Our expertly prepared valuation report Press Metal Aluminium Holdings Berhad implies its share price may be lower than expected.

Top Glove Corporation Bhd (KLSE:TOPGLOV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Top Glove Corporation Bhd., an investment holding company with a market cap of MYR7.33 billion, manufactures, trades in, and sells gloves in Malaysia, Thailand, the People’s Republic of China, and internationally.

Operations: The company's revenue from the gloves manufacturing industry is MYR2.16 billion.

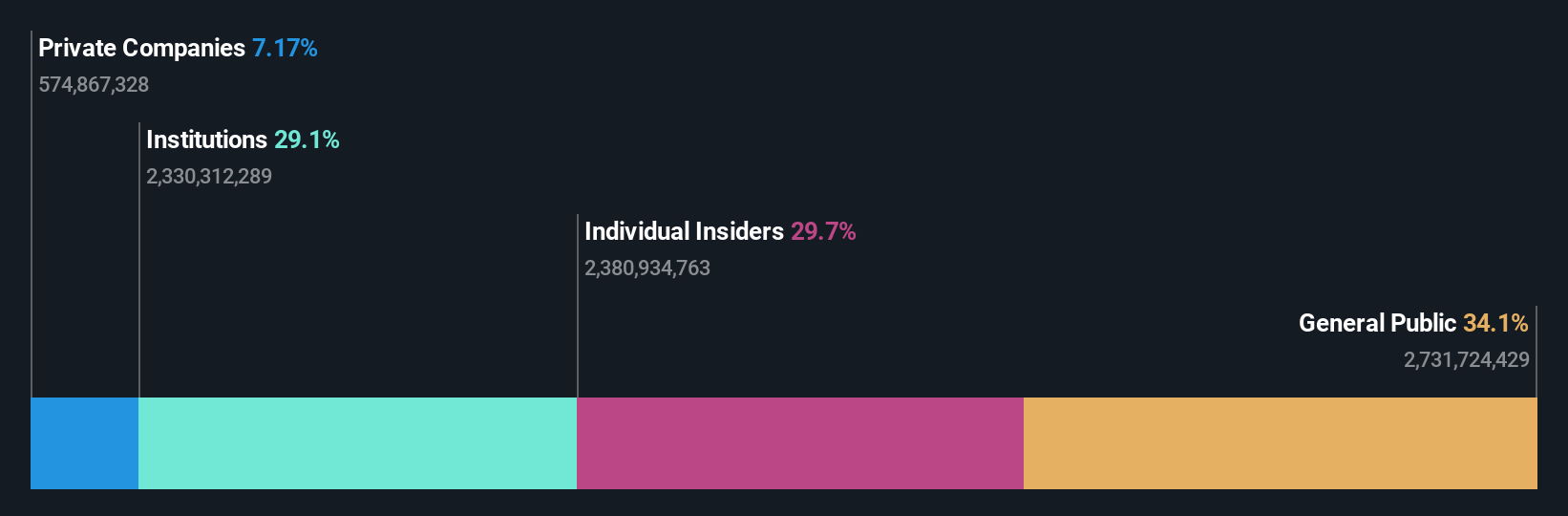

Insider Ownership: 29.9%

Top Glove Corporation Bhd. showcases significant insider ownership, aligning management interests with shareholders. Recent earnings reveal a turnaround, with MYR 62.42 million net income for Q3 2024 compared to a net loss the previous year. Revenue is forecasted to grow at 34.3% annually, outpacing market averages, and the company is expected to become profitable within three years despite recent board changes that may affect strategic direction.

- Delve into the full analysis future growth report here for a deeper understanding of Top Glove Corporation Bhd.

- Insights from our recent valuation report point to the potential overvaluation of Top Glove Corporation Bhd shares in the market.

Grupa Pracuj (WSE:GPP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Grupa Pracuj S.A. operates in the digital recruitment market in Poland and Ukraine, with a market cap of PLN3.68 billion.

Operations: The company's revenue from Staffing & Outsourcing Services amounts to PLN744.28 million.

Insider Ownership: 12.1%

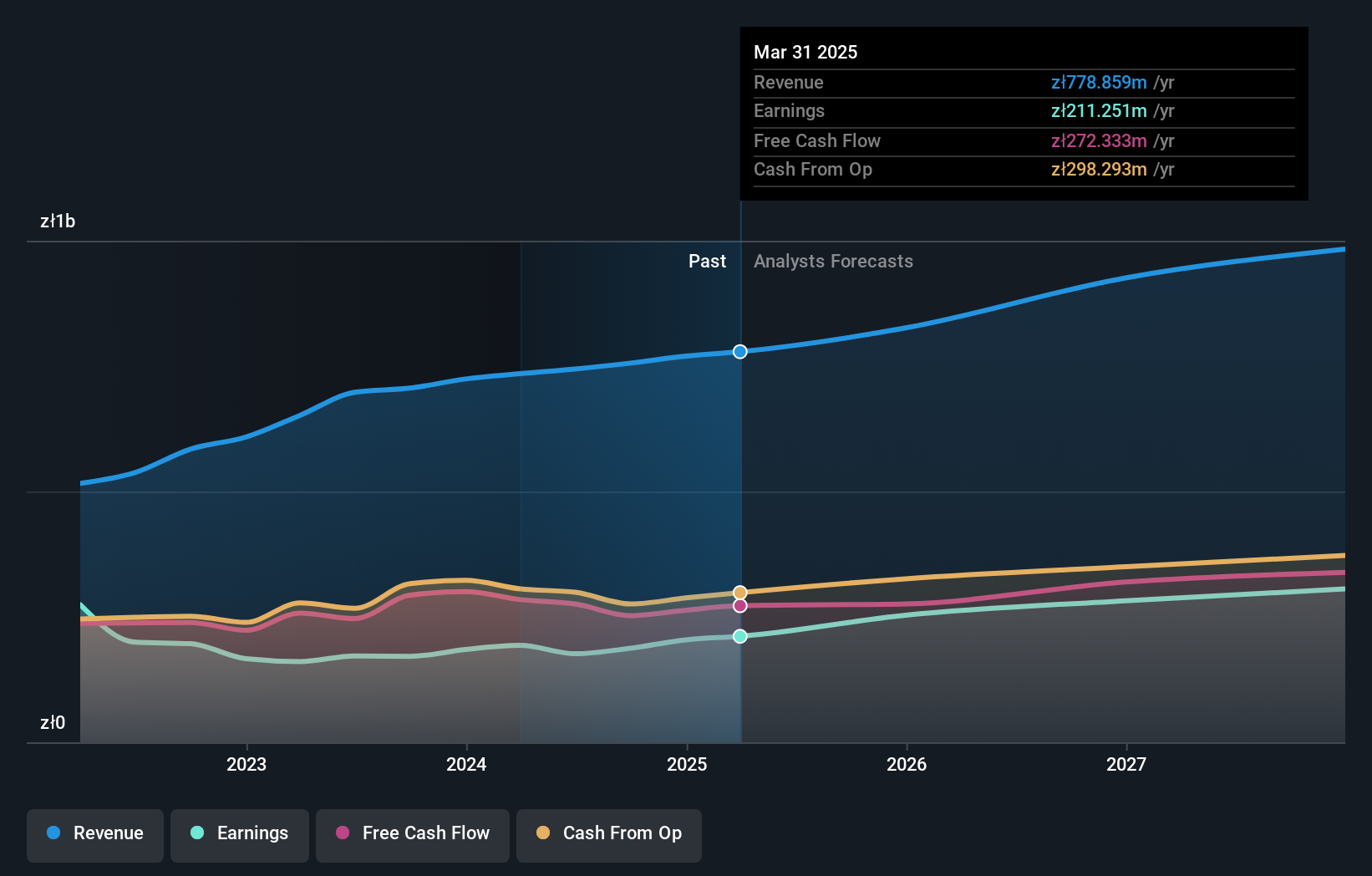

Grupa Pracuj demonstrates strong insider ownership, reflecting confidence in its growth trajectory. Despite a dip in Q2 2024 net income to PLN 41.54 million from PLN 58.36 million a year ago, revenue rose to PLN 193.59 million from PLN 184.35 million. Analysts forecast annual earnings growth of 16.24%, outpacing the Polish market's average and expect revenue to grow at 8.7% annually, with the stock trading significantly below estimated fair value by analysts' consensus.

- Dive into the specifics of Grupa Pracuj here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Grupa Pracuj's current price could be quite moderate.

Next Steps

- Explore the 1485 names from our Fast Growing Companies With High Insider Ownership screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Press Metal Aluminium Holdings Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KLSE:PMETAL

Press Metal Aluminium Holdings Berhad

Engages in the manufacture and trading of aluminum, and smelting and extrusion products in Malaysia, Asia, Europe, the Oceania, Europe, and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives