- Malaysia

- /

- Medical Equipment

- /

- KLSE:SUPERMX

Investors Still Aren't Entirely Convinced By Supermax Corporation Berhad's (KLSE:SUPERMX) Revenues Despite 26% Price Jump

Supermax Corporation Berhad (KLSE:SUPERMX) shares have continued their recent momentum with a 26% gain in the last month alone. Looking further back, the 25% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

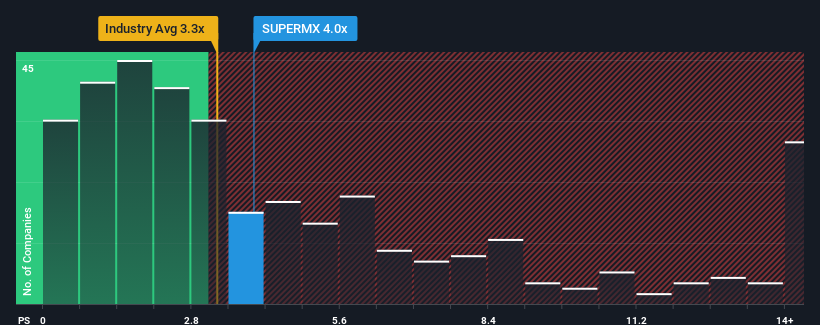

Although its price has surged higher, there still wouldn't be many who think Supermax Corporation Berhad's price-to-sales (or "P/S") ratio of 4x is worth a mention when the median P/S in Malaysia's Medical Equipment industry is similar at about 3.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Supermax Corporation Berhad

How Supermax Corporation Berhad Has Been Performing

While the industry has experienced revenue growth lately, Supermax Corporation Berhad's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Supermax Corporation Berhad's future stacks up against the industry? In that case, our free report is a great place to start.How Is Supermax Corporation Berhad's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Supermax Corporation Berhad's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 7.8% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 90% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 63% over the next year. With the industry only predicted to deliver 19%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Supermax Corporation Berhad's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

Supermax Corporation Berhad's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Looking at Supermax Corporation Berhad's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Having said that, be aware Supermax Corporation Berhad is showing 1 warning sign in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:SUPERMX

Supermax Corporation Berhad

An investment holding company, manufactures, distributes, and markets medical gloves and contact lenses in Europe, North America, Central America, South America, Asia, Oceania, and Africa.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives