- Malaysia

- /

- Medical Equipment

- /

- KLSE:LKL

Investors Aren't Entirely Convinced By LKL International Berhad's (KLSE:LKL) Revenues

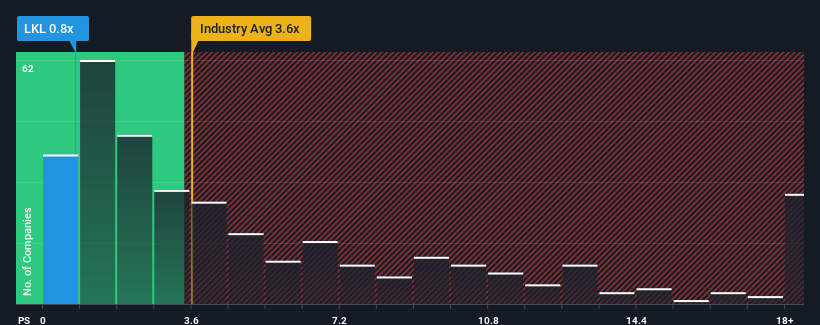

When you see that almost half of the companies in the Medical Equipment industry in Malaysia have price-to-sales ratios (or "P/S") above 1.7x, LKL International Berhad (KLSE:LKL) looks to be giving off some buy signals with its 0.8x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for LKL International Berhad

How LKL International Berhad Has Been Performing

Recent times have been quite advantageous for LKL International Berhad as its revenue has been rising very briskly. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on LKL International Berhad will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For LKL International Berhad?

LKL International Berhad's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 39% last year. The strong recent performance means it was also able to grow revenue by 94% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 24% shows it's about the same on an annualised basis.

In light of this, it's peculiar that LKL International Berhad's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can maintain recent growth rates.

The Bottom Line On LKL International Berhad's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

The fact that LKL International Berhad currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. medium-term

And what about other risks? Every company has them, and we've spotted 4 warning signs for LKL International Berhad (of which 3 make us uncomfortable!) you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:LKL

LKL International Berhad

An investment holding company, manufactures, sells, and trades in medical and healthcare beds, medical peripherals, and related accessories under the LKL brand in Malaysia, Africa, Central America, Europe, the Middle East, and the rest of Asia.

Slight with mediocre balance sheet.

Market Insights

Community Narratives