- Malaysia

- /

- Medical Equipment

- /

- KLSE:LKL

If You Had Bought LKL International Berhad (KLSE:LKL) Stock A Year Ago, You Could Pocket A 773% Gain Today

For many, the main point of investing in the stock market is to achieve spectacular returns. When you find (and hold) a big winner, you can markedly improve your finances. For example, the LKL International Berhad (KLSE:LKL) share price rocketed moonwards 773% in just one year. In the last week shares have slid back 5.0%. Also impressive, the stock is up 380% over three years, making long term shareholders happy, too.

Anyone who held for that rewarding ride would probably be keen to talk about it.

View our latest analysis for LKL International Berhad

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year LKL International Berhad grew its earnings per share, moving from a loss to a profit.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action.

However the year on year revenue growth of 67% would help. We do see some companies suppress earnings in order to accelerate revenue growth.

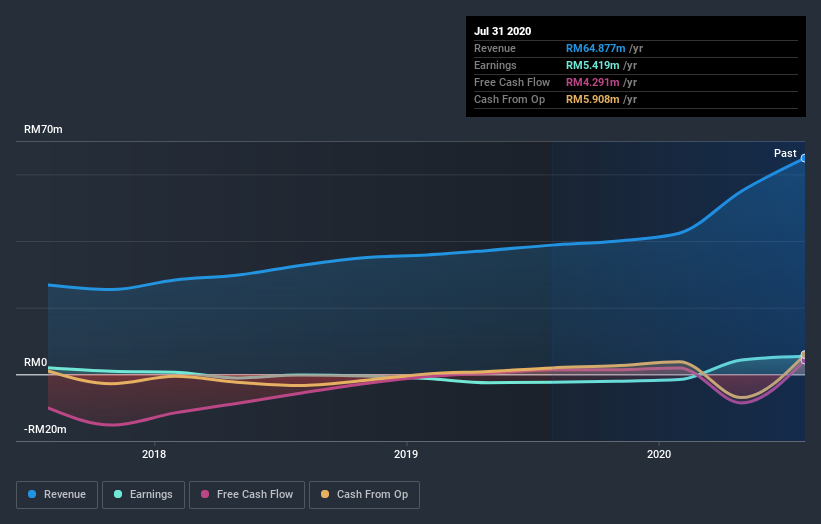

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on LKL International Berhad's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Pleasingly, LKL International Berhad's total shareholder return last year was 773%. That's better than the annualized TSR of 69% over the last three years. Given the track record of solid returns over varying time frames, it might be worth putting LKL International Berhad on your watchlist. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 2 warning signs for LKL International Berhad (1 is significant) that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

When trading LKL International Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:LKL

LKL International Berhad

An investment holding company, manufactures, sells, and trades in medical and healthcare beds, medical peripherals, and related accessories under the LKL brand in Malaysia, Africa, Central America, Europe, the Middle East, and the rest of Asia.

Slight with mediocre balance sheet.

Market Insights

Community Narratives