- Malaysia

- /

- Medical Equipment

- /

- KLSE:KOSSAN

Optimistic Investors Push Kossan Rubber Industries Bhd (KLSE:KOSSAN) Shares Up 25% But Growth Is Lacking

Despite an already strong run, Kossan Rubber Industries Bhd (KLSE:KOSSAN) shares have been powering on, with a gain of 25% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 88% in the last year.

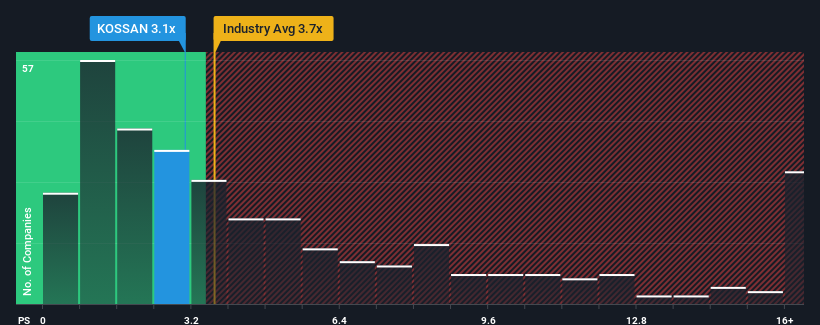

In spite of the firm bounce in price, it's still not a stretch to say that Kossan Rubber Industries Bhd's price-to-sales (or "P/S") ratio of 3.1x right now seems quite "middle-of-the-road" compared to the Medical Equipment industry in Malaysia, seeing as it matches the P/S ratio of the wider industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Kossan Rubber Industries Bhd

How Has Kossan Rubber Industries Bhd Performed Recently?

Recent times have been more advantageous for Kossan Rubber Industries Bhd as its revenue hasn't fallen as much as the rest of the industry. One possibility is that the P/S ratio is moderate because investors think this relatively better revenue performance might be about to evaporate. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's revenue continues outplaying the industry.

Want the full picture on analyst estimates for the company? Then our free report on Kossan Rubber Industries Bhd will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Kossan Rubber Industries Bhd's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 38% decrease to the company's top line. As a result, revenue from three years ago have also fallen 42% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 14% during the coming year according to the analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 22%, which is noticeably more attractive.

With this information, we find it interesting that Kossan Rubber Industries Bhd is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Kossan Rubber Industries Bhd appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at the analysts forecasts of Kossan Rubber Industries Bhd's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you take the next step, you should know about the 2 warning signs for Kossan Rubber Industries Bhd that we have uncovered.

If these risks are making you reconsider your opinion on Kossan Rubber Industries Bhd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Kossan Rubber Industries Bhd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:KOSSAN

Kossan Rubber Industries Bhd

An investment holding company, manufactures and sells latex disposable gloves in Malaysia and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives