- Malaysia

- /

- Medical Equipment

- /

- KLSE:HARTA

With Hartalega Holdings Berhad (KLSE:HARTA) It Looks Like You'll Get What You Pay For

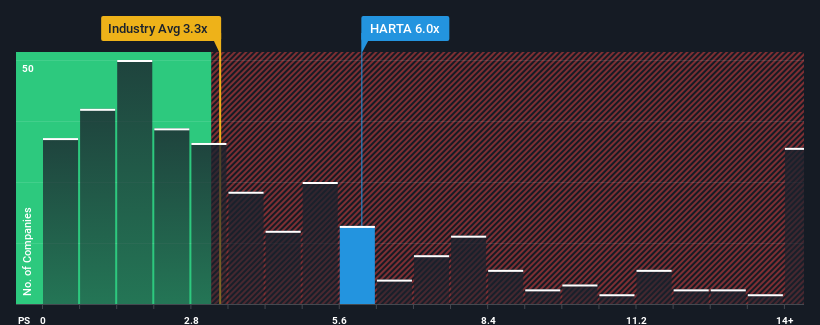

When close to half the companies in the Medical Equipment industry in Malaysia have price-to-sales ratios (or "P/S") below 3.6x, you may consider Hartalega Holdings Berhad (KLSE:HARTA) as a stock to avoid entirely with its 6x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Hartalega Holdings Berhad

How Has Hartalega Holdings Berhad Performed Recently?

Recent revenue growth for Hartalega Holdings Berhad has been in line with the industry. Perhaps the market is expecting future revenue performance to improve, justifying the currently elevated P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Hartalega Holdings Berhad's future stacks up against the industry? In that case, our free report is a great place to start.How Is Hartalega Holdings Berhad's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Hartalega Holdings Berhad's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 17%. Still, revenue has fallen 79% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 35% during the coming year according to the analysts following the company. With the industry only predicted to deliver 19%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Hartalega Holdings Berhad's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Hartalega Holdings Berhad maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Medical Equipment industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Hartalega Holdings Berhad with six simple checks.

If these risks are making you reconsider your opinion on Hartalega Holdings Berhad, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Hartalega Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:HARTA

Hartalega Holdings Berhad

An investment holding company, engages in the manufacture, retail, and wholesale of latex and nitrile gloves in Malaysia, North America, Europe, Asia, Australia, the Middle East, and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives