- Malaysia

- /

- Medical Equipment

- /

- KLSE:HARTA

Some Confidence Is Lacking In Hartalega Holdings Berhad's (KLSE:HARTA) P/S

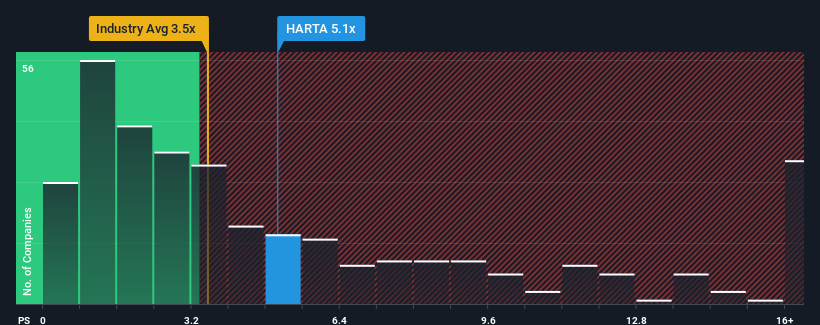

When close to half the companies in the Medical Equipment industry in Malaysia have price-to-sales ratios (or "P/S") below 3.2x, you may consider Hartalega Holdings Berhad (KLSE:HARTA) as a stock to potentially avoid with its 5.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Hartalega Holdings Berhad

How Hartalega Holdings Berhad Has Been Performing

The recently shrinking revenue for Hartalega Holdings Berhad has been in line with the industry. Perhaps the market is expecting the company to reverse its fortunes and beat out a struggling industry in the future, elevating the P/S. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Hartalega Holdings Berhad's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Hartalega Holdings Berhad?

In order to justify its P/S ratio, Hartalega Holdings Berhad would need to produce impressive growth in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 45%. The last three years don't look nice either as the company has shrunk revenue by 51% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 2.9% each year during the coming three years according to the analysts following the company. That's shaping up to be materially lower than the 23% per annum growth forecast for the broader industry.

With this information, we find it concerning that Hartalega Holdings Berhad is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It comes as a surprise to see Hartalega Holdings Berhad trade at such a high P/S given the revenue forecasts look less than stellar. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Hartalega Holdings Berhad with six simple checks.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Hartalega Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:HARTA

Hartalega Holdings Berhad

An investment holding company, engages in the manufacture, retail, and wholesale of latex and nitrile gloves in Malaysia, North America, Europe, Asia, Australia, the Middle East, and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives