- Malaysia

- /

- Medical Equipment

- /

- KLSE:CAREPLS

Little Excitement Around Careplus Group Berhad's (KLSE:CAREPLS) Revenues

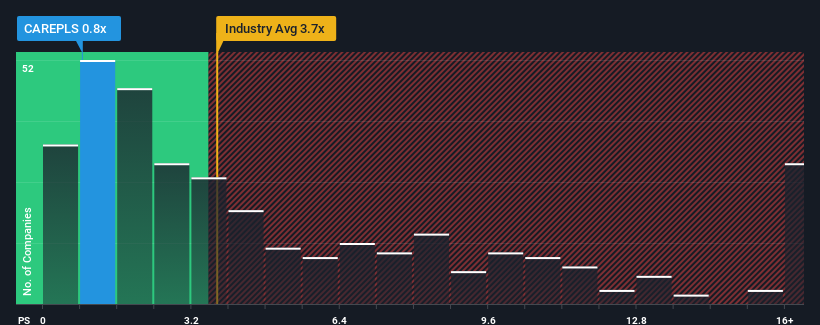

When you see that almost half of the companies in the Medical Equipment industry in Malaysia have price-to-sales ratios (or "P/S") above 1.9x, Careplus Group Berhad (KLSE:CAREPLS) looks to be giving off some buy signals with its 0.8x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Careplus Group Berhad

How Careplus Group Berhad Has Been Performing

For instance, Careplus Group Berhad's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Careplus Group Berhad will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Careplus Group Berhad?

The only time you'd be truly comfortable seeing a P/S as low as Careplus Group Berhad's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 46% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 51% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

In contrast to the company, the rest of the industry is expected to grow by 22% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's understandable that Careplus Group Berhad's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Careplus Group Berhad revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Careplus Group Berhad (of which 1 doesn't sit too well with us!) you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:CAREPLS

Careplus Group Berhad

An investment holding company, manufactures and processes gloves in South America, North America, Malaysia, rest of Asia Pacific, and internationally.

Adequate balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.