David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Adventa Berhad (KLSE:ADVENTA) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Adventa Berhad

What Is Adventa Berhad's Net Debt?

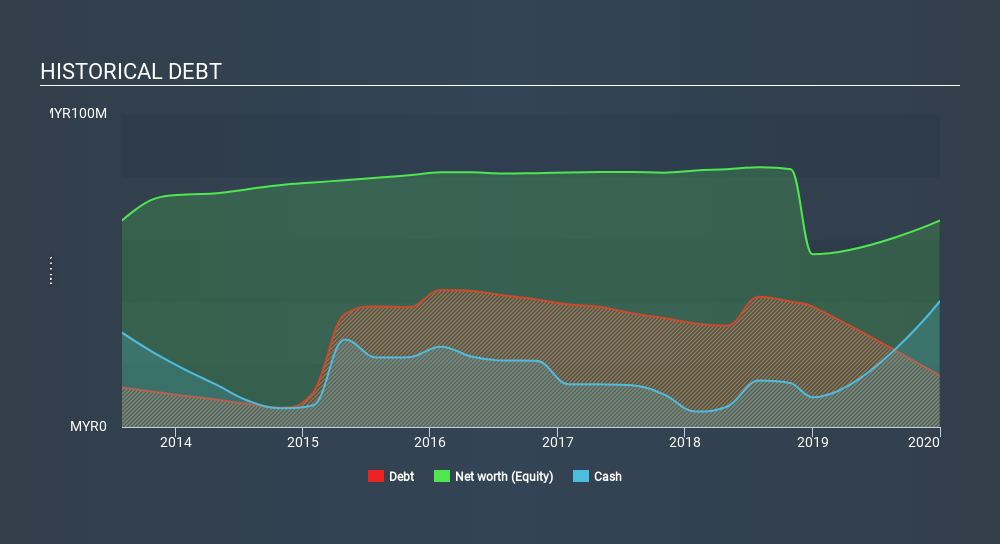

The image below, which you can click on for greater detail, shows that Adventa Berhad had debt of RM16.5m at the end of December 2019, a reduction from RM38.6m over a year. But on the other hand it also has RM40.1m in cash, leading to a RM23.6m net cash position.

A Look At Adventa Berhad's Liabilities

According to the last reported balance sheet, Adventa Berhad had liabilities of RM30.8m due within 12 months, and liabilities of RM4.22m due beyond 12 months. Offsetting these obligations, it had cash of RM40.1m as well as receivables valued at RM23.2m due within 12 months. So it actually has RM28.3m more liquid assets than total liabilities.

It's good to see that Adventa Berhad has plenty of liquidity on its balance sheet, suggesting conservative management of liabilities. Because it has plenty of assets, it is unlikely to have trouble with its lenders. Simply put, the fact that Adventa Berhad has more cash than debt is arguably a good indication that it can manage its debt safely. When analysing debt levels, the balance sheet is the obvious place to start. But it is Adventa Berhad's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Adventa Berhad made a loss at the EBIT level, and saw its revenue drop to RM39m, which is a fall of 24%. To be frank that doesn't bode well.

So How Risky Is Adventa Berhad?

Although Adventa Berhad had negative earnings before interest and tax (EBIT) over the last twelve months, it made a statutory profit of RM22m. So when you consider it has net cash, along with the statutory profit, the stock probably isn't as risky as it might seem, at least in the short term. With mediocre revenue growth in the last year, we're don't find the investment opportunity particularly compelling. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 3 warning signs for Adventa Berhad you should be aware of, and 1 of them doesn't sit too well with us.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About KLSE:ADVENTA

Adventa Berhad

An investment holding company, engages in the supply of healthcare and related products and services to hospitals, healthcare centers, and pharmacies in Malaysia, Sri Lanka, and internationally.

Excellent balance sheet with acceptable track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion