Does TH Plantations Berhad (KLSE:THPLANT) Have A Healthy Balance Sheet?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, TH Plantations Berhad (KLSE:THPLANT) does carry debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for TH Plantations Berhad

What Is TH Plantations Berhad's Debt?

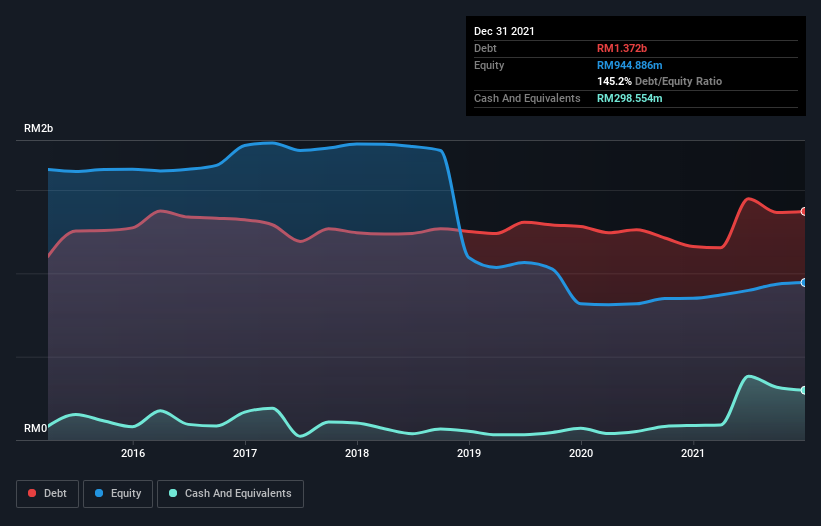

You can click the graphic below for the historical numbers, but it shows that as of December 2021 TH Plantations Berhad had RM1.37b of debt, an increase on RM1.16b, over one year. On the flip side, it has RM298.6m in cash leading to net debt of about RM1.07b.

A Look At TH Plantations Berhad's Liabilities

According to the last reported balance sheet, TH Plantations Berhad had liabilities of RM705.9m due within 12 months, and liabilities of RM1.21b due beyond 12 months. On the other hand, it had cash of RM298.6m and RM38.1m worth of receivables due within a year. So it has liabilities totalling RM1.58b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the RM848.5m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, TH Plantations Berhad would probably need a major re-capitalization if its creditors were to demand repayment.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

TH Plantations Berhad's debt is 3.7 times its EBITDA, and its EBIT cover its interest expense 2.7 times over. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. The good news is that TH Plantations Berhad grew its EBIT a smooth 65% over the last twelve months. Like the milk of human kindness that sort of growth increases resilience, making the company more capable of managing debt. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine TH Plantations Berhad's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Looking at the most recent three years, TH Plantations Berhad recorded free cash flow of 42% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

Mulling over TH Plantations Berhad's attempt at staying on top of its total liabilities, we're certainly not enthusiastic. But at least it's pretty decent at growing its EBIT; that's encouraging. Overall, we think it's fair to say that TH Plantations Berhad has enough debt that there are some real risks around the balance sheet. If everything goes well that may pay off but the downside of this debt is a greater risk of permanent losses. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Be aware that TH Plantations Berhad is showing 3 warning signs in our investment analysis , and 2 of those are potentially serious...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if TH Plantations Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:THPLANT

TH Plantations Berhad

An investment holding company, engages in the cultivation of oil palm in Malaysia and Indonesia.

Excellent balance sheet and fair value.

Market Insights

Community Narratives