Not Many Are Piling Into Rimbunan Sawit Berhad (KLSE:RSAWIT) Just Yet

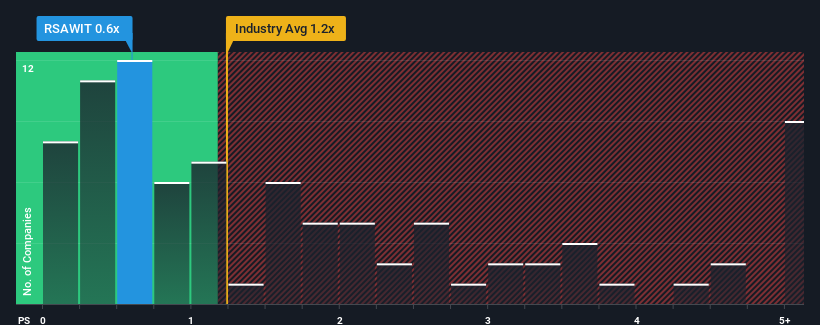

When close to half the companies operating in the Food industry in Malaysia have price-to-sales ratios (or "P/S") above 1.2x, you may consider Rimbunan Sawit Berhad (KLSE:RSAWIT) as an attractive investment with its 0.6x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Rimbunan Sawit Berhad

How Rimbunan Sawit Berhad Has Been Performing

As an illustration, revenue has deteriorated at Rimbunan Sawit Berhad over the last year, which is not ideal at all. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. Those who are bullish on Rimbunan Sawit Berhad will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Rimbunan Sawit Berhad's earnings, revenue and cash flow.How Is Rimbunan Sawit Berhad's Revenue Growth Trending?

In order to justify its P/S ratio, Rimbunan Sawit Berhad would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 22%. Still, the latest three year period has seen an excellent 61% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 2.6% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that Rimbunan Sawit Berhad's P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Rimbunan Sawit Berhad revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Rimbunan Sawit Berhad, and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Rimbunan Sawit Berhad, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:RSAWIT

Rimbunan Sawit Berhad

An investment holding company, engages in the cultivation of oil palm in Malaysia.

Proven track record and slightly overvalued.

Market Insights

Community Narratives