Does The Market Have A Low Tolerance For Orgabio Holdings Berhad's (KLSE:ORGABIO) Mixed Fundamentals?

With its stock down 13% over the past three months, it is easy to disregard Orgabio Holdings Berhad (KLSE:ORGABIO). It is possible that the markets have ignored the company's differing financials and decided to lean-in to the negative sentiment. Stock prices are usually driven by a company’s financial performance over the long term, and therefore we decided to pay more attention to the company's financial performance. Specifically, we decided to study Orgabio Holdings Berhad's ROE in this article.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

View our latest analysis for Orgabio Holdings Berhad

How Do You Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Orgabio Holdings Berhad is:

7.4% = RM4.1m ÷ RM56m (Based on the trailing twelve months to June 2024).

The 'return' is the yearly profit. One way to conceptualize this is that for each MYR1 of shareholders' capital it has, the company made MYR0.07 in profit.

What Has ROE Got To Do With Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Orgabio Holdings Berhad's Earnings Growth And 7.4% ROE

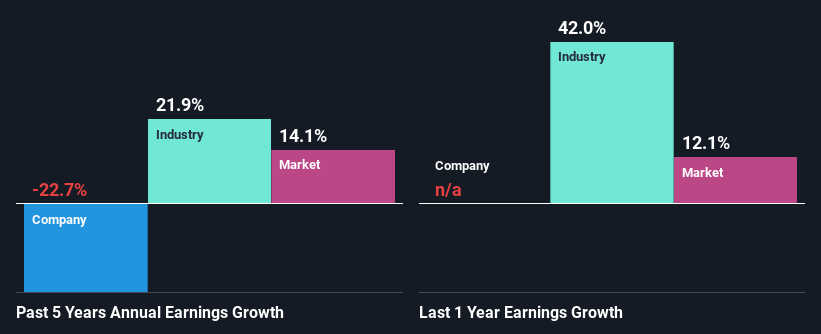

On the face of it, Orgabio Holdings Berhad's ROE is not much to talk about. We then compared the company's ROE to the broader industry and were disappointed to see that the ROE is lower than the industry average of 10.0%. For this reason, Orgabio Holdings Berhad's five year net income decline of 23% is not surprising given its lower ROE. We believe that there also might be other aspects that are negatively influencing the company's earnings prospects. Such as - low earnings retention or poor allocation of capital.

That being said, we compared Orgabio Holdings Berhad's performance with the industry and were concerned when we found that while the company has shrunk its earnings, the industry has grown its earnings at a rate of 22% in the same 5-year period.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Orgabio Holdings Berhad is trading on a high P/E or a low P/E, relative to its industry.

Is Orgabio Holdings Berhad Using Its Retained Earnings Effectively?

Orgabio Holdings Berhad doesn't pay any regular dividends, meaning that the company is keeping all of its profits, which makes us wonder why it is retaining its earnings if it can't use them to grow its business. So there could be some other explanations in that regard. For instance, the company's business may be deteriorating.

Summary

In total, we're a bit ambivalent about Orgabio Holdings Berhad's performance. While the company does have a high rate of reinvestment, the low ROE means that all that reinvestment is not reaping any benefit to its investors, and moreover, its having a negative impact on the earnings growth. Wrapping up, we would proceed with caution with this company and one way of doing that would be to look at the risk profile of the business. To know the 2 risks we have identified for Orgabio Holdings Berhad visit our risks dashboard for free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:ORGABIO

Orgabio Holdings Berhad

An investment holding company, engages in the provision of instant beverage premix manufacturing services to third party brand owners in Malaysia, Republic of Singapore, China, Papua New Guinea, Trinidad and Tobago, and internationally.

Flawless balance sheet with low risk.

Market Insights

Community Narratives