MSM Malaysia Holdings Berhad (KLSE:MSM) Might Not Be As Mispriced As It Looks After Plunging 26%

Unfortunately for some shareholders, the MSM Malaysia Holdings Berhad (KLSE:MSM) share price has dived 26% in the last thirty days, prolonging recent pain. Looking at the bigger picture, even after this poor month the stock is up 52% in the last year.

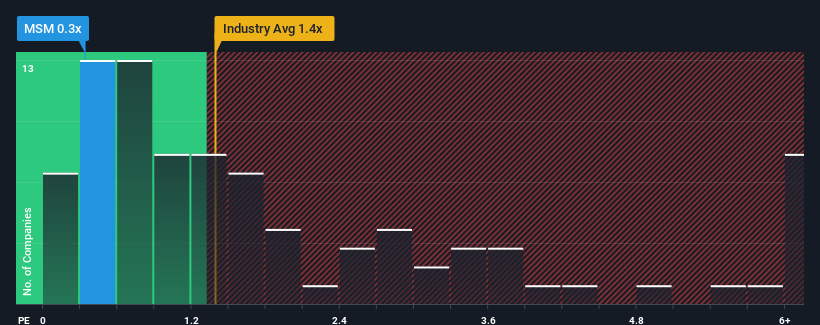

In spite of the heavy fall in price, considering around half the companies operating in Malaysia's Food industry have price-to-sales ratios (or "P/S") above 1.4x, you may still consider MSM Malaysia Holdings Berhad as an solid investment opportunity with its 0.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for MSM Malaysia Holdings Berhad

How Has MSM Malaysia Holdings Berhad Performed Recently?

MSM Malaysia Holdings Berhad certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. One possibility is that the P/S ratio is low because investors think the company's revenue is going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on MSM Malaysia Holdings Berhad.How Is MSM Malaysia Holdings Berhad's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like MSM Malaysia Holdings Berhad's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 33%. Pleasingly, revenue has also lifted 56% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 22% as estimated by the two analysts watching the company. With the industry only predicted to deliver 6.8%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that MSM Malaysia Holdings Berhad's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

The southerly movements of MSM Malaysia Holdings Berhad's shares means its P/S is now sitting at a pretty low level. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

MSM Malaysia Holdings Berhad's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Plus, you should also learn about these 2 warning signs we've spotted with MSM Malaysia Holdings Berhad (including 1 which is a bit unpleasant).

If these risks are making you reconsider your opinion on MSM Malaysia Holdings Berhad, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:MSM

MSM Malaysia Holdings Berhad

A refined sugar producer, produces, refines, markets, and sells refined sugar products in Malaysia.

Solid track record with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Growing between 25-50% for the next 3-5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026