We're Not Counting On Kluang Rubber Company (Malaya) Berhad (KLSE:KLUANG) To Sustain Its Statutory Profitability

Statistically speaking, it is less risky to invest in profitable companies than in unprofitable ones. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. This article will consider whether Kluang Rubber Company (Malaya) Berhad's (KLSE:KLUANG) statutory profits are a good guide to its underlying earnings.

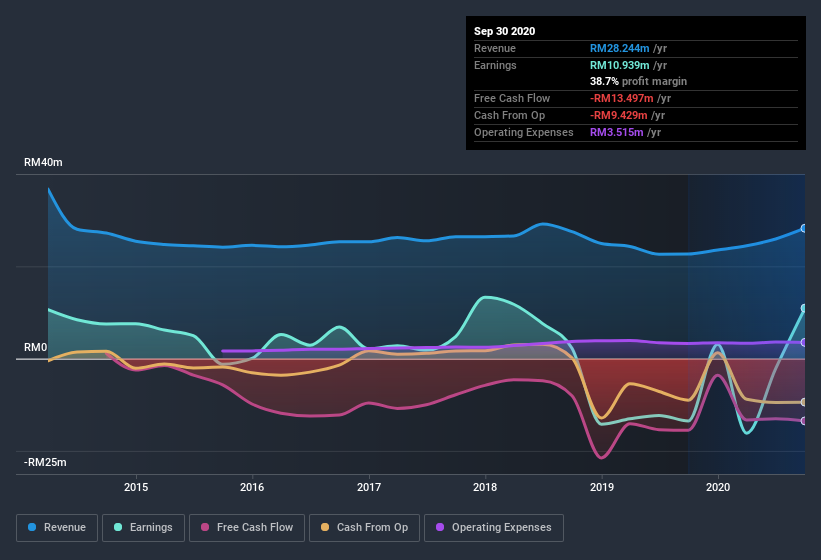

We like the fact that Kluang Rubber Company (Malaya) Berhad made a profit of RM10.9m on its revenue of RM28.2m, in the last year.

View our latest analysis for Kluang Rubber Company (Malaya) Berhad

Importantly, statutory profits are not always the best tool for understanding a company's true earnings power, so it's well worth examining profits in a little more detail. This article, will discuss how unusual items and a tax benefit have impacted Kluang Rubber Company (Malaya) Berhad's most recent bottom line results. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Kluang Rubber Company (Malaya) Berhad.

The Impact Of Unusual Items On Profit

To properly understand Kluang Rubber Company (Malaya) Berhad's profit results, we need to consider the RM9.9m gain attributed to unusual items. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. Which is hardly surprising, given the name. We can see that Kluang Rubber Company (Malaya) Berhad's positive unusual items were quite significant relative to its profit in the year to September 2020. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

An Unusual Tax Situation

Just as we noted the unusual items, we must inform you that Kluang Rubber Company (Malaya) Berhad received a tax benefit which contributed RM1.9m to the bottom line. This is meaningful because companies usually pay tax rather than receive tax benefits. We're sure the company was pleased with its tax benefit. And since it previously lost money, it may well simply indicate the realisation of past tax losses. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth.

Our Take On Kluang Rubber Company (Malaya) Berhad's Profit Performance

In the last year Kluang Rubber Company (Malaya) Berhad received a tax benefit, which boosted its profit in a way that might not be much more sustainable than turning prime farmland into gas fields. Furthermore, it also benefitted from a positive unusual item, which boosted the profit result even higher. For all the reasons mentioned above, we think that, at a glance, Kluang Rubber Company (Malaya) Berhad's statutory profits could be considered to be low quality, because they are likely to give investors an overly positive impression of the company. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. You'd be interested to know, that we found 2 warning signs for Kluang Rubber Company (Malaya) Berhad and you'll want to know about these bad boys.

Our examination of Kluang Rubber Company (Malaya) Berhad has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade Kluang Rubber Company (Malaya) Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Kluang Rubber Company (Malaya) Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kluang Rubber Company (Malaya) Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:KLUANG

Kluang Rubber Company (Malaya) Berhad

An investment holding company, produces and sells fresh oil palm fruit bunches in Malaysia, Singapore, and the United Kingdom.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives