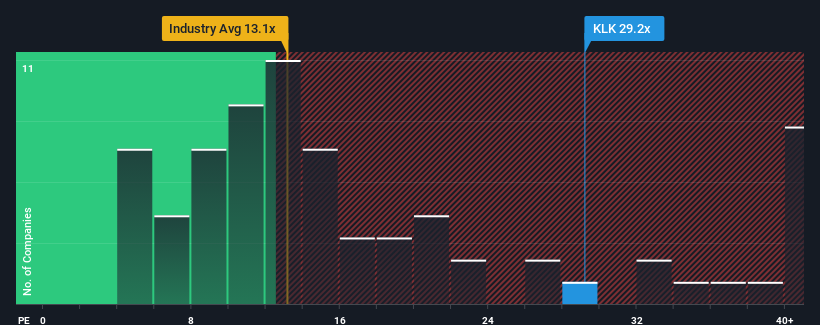

When close to half the companies in Malaysia have price-to-earnings ratios (or "P/E's") below 15x, you may consider Kuala Lumpur Kepong Berhad (KLSE:KLK) as a stock to avoid entirely with its 29.2x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings that are retreating more than the market's of late, Kuala Lumpur Kepong Berhad has been very sluggish. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

View our latest analysis for Kuala Lumpur Kepong Berhad

How Is Kuala Lumpur Kepong Berhad's Growth Trending?

In order to justify its P/E ratio, Kuala Lumpur Kepong Berhad would need to produce outstanding growth well in excess of the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 61%. Regardless, EPS has managed to lift by a handy 7.4% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 23% per year during the coming three years according to the analysts following the company. That's shaping up to be materially higher than the 9.8% each year growth forecast for the broader market.

With this information, we can see why Kuala Lumpur Kepong Berhad is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Kuala Lumpur Kepong Berhad's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Kuala Lumpur Kepong Berhad (at least 1 which makes us a bit uncomfortable), and understanding these should be part of your investment process.

If you're unsure about the strength of Kuala Lumpur Kepong Berhad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Kuala Lumpur Kepong Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:KLK

Kuala Lumpur Kepong Berhad

Engages in the plantation, manufacturing, and property development businesses.

Reasonable growth potential with mediocre balance sheet.