Shareholders May Be Wary Of Increasing Hap Seng Plantations Holdings Berhad's (KLSE:HSPLANT) CEO Compensation Package

Key Insights

- Hap Seng Plantations Holdings Berhad to hold its Annual General Meeting on 27th of May

- CEO Edward Lee's total compensation includes salary of RM565.0k

- The total compensation is similar to the average for the industry

- Hap Seng Plantations Holdings Berhad's EPS declined by 3.0% over the past three years while total shareholder loss over the past three years was 23%

Shareholders will probably not be too impressed with the underwhelming results at Hap Seng Plantations Holdings Berhad (KLSE:HSPLANT) recently. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 27th of May. They will also get a chance to influence managerial decision-making through voting on resolutions such as executive remuneration, which may impact firm value in the future. We present the case why we think CEO compensation is out of sync with company performance.

View our latest analysis for Hap Seng Plantations Holdings Berhad

How Does Total Compensation For Edward Lee Compare With Other Companies In The Industry?

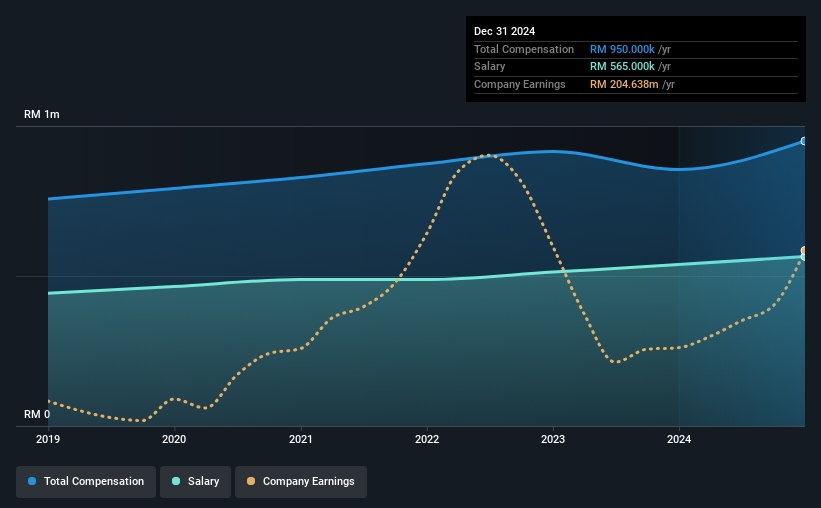

According to our data, Hap Seng Plantations Holdings Berhad has a market capitalization of RM1.5b, and paid its CEO total annual compensation worth RM950k over the year to December 2024. We note that's an increase of 11% above last year. Notably, the salary which is RM565.0k, represents a considerable chunk of the total compensation being paid.

For comparison, other companies in the Malaysian Food industry with market capitalizations ranging between RM859m and RM3.4b had a median total CEO compensation of RM951k. So it looks like Hap Seng Plantations Holdings Berhad compensates Edward Lee in line with the median for the industry.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | RM565k | RM538k | 59% |

| Other | RM385k | RM317k | 41% |

| Total Compensation | RM950k | RM855k | 100% |

On an industry level, around 64% of total compensation represents salary and 36% is other remuneration. Our data reveals that Hap Seng Plantations Holdings Berhad allocates salary more or less in line with the wider market. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Hap Seng Plantations Holdings Berhad's Growth Numbers

Hap Seng Plantations Holdings Berhad has reduced its earnings per share by 3.0% a year over the last three years. It achieved revenue growth of 13% over the last year.

The lack of EPS growth is certainly uninspiring. There's no doubt that the silver lining is that revenue is up. But it isn't sufficiently fast growth to overlook the fact that EPS has gone backwards over three years. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Hap Seng Plantations Holdings Berhad Been A Good Investment?

Since shareholders would have lost about 23% over three years, some Hap Seng Plantations Holdings Berhad investors would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. That's why we did our research, and identified 2 warning signs for Hap Seng Plantations Holdings Berhad (of which 1 is potentially serious!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from Hap Seng Plantations Holdings Berhad, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Valuation is complex, but we're here to simplify it.

Discover if Hap Seng Plantations Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:HSPLANT

Hap Seng Plantations Holdings Berhad

An investment holding company, operates as an oil palm plantation company in Malaysia.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives