Hap Seng Plantations Holdings Berhad's (KLSE:HSPLANT) Stock Going Strong But Fundamentals Look Weak: What Implications Could This Have On The Stock?

Most readers would already be aware that Hap Seng Plantations Holdings Berhad's (KLSE:HSPLANT) stock increased significantly by 13% over the past three months. We, however wanted to have a closer look at its key financial indicators as the markets usually pay for long-term fundamentals, and in this case, they don't look very promising. Specifically, we decided to study Hap Seng Plantations Holdings Berhad's ROE in this article.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Put another way, it reveals the company's success at turning shareholder investments into profits.

View our latest analysis for Hap Seng Plantations Holdings Berhad

How Is ROE Calculated?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Hap Seng Plantations Holdings Berhad is:

3.6% = RM60m ÷ RM1.7b (Based on the trailing twelve months to June 2020).

The 'return' is the amount earned after tax over the last twelve months. One way to conceptualize this is that for each MYR1 of shareholders' capital it has, the company made MYR0.04 in profit.

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Hap Seng Plantations Holdings Berhad's Earnings Growth And 3.6% ROE

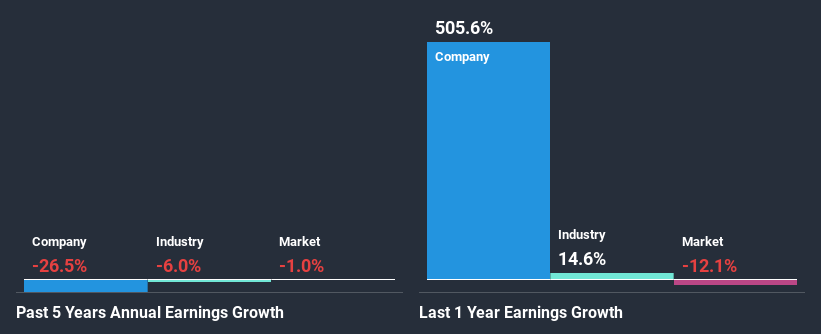

It is hard to argue that Hap Seng Plantations Holdings Berhad's ROE is much good in and of itself. Not just that, even compared to the industry average of 6.8%, the company's ROE is entirely unremarkable. Given the circumstances, the significant decline in net income by 27% seen by Hap Seng Plantations Holdings Berhad over the last five years is not surprising. However, there could also be other factors causing the earnings to decline. Such as - low earnings retention or poor allocation of capital.

Furthermore, even when compared to the industry, which has been shrinking its earnings at a rate 6.0% in the same period, we found that Hap Seng Plantations Holdings Berhad's performance is pretty disappointing, as it suggests that the company has been shrunk its earnings at a rate faster than the industry.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Hap Seng Plantations Holdings Berhad is trading on a high P/E or a low P/E, relative to its industry.

Is Hap Seng Plantations Holdings Berhad Efficiently Re-investing Its Profits?

Hap Seng Plantations Holdings Berhad's declining earnings is not surprising given how the company is spending most of its profits in paying dividends, judging by its three-year median payout ratio of 81% (or a retention ratio of 19%). With only a little being reinvested into the business, earnings growth would obviously be low or non-existent. To know the 2 risks we have identified for Hap Seng Plantations Holdings Berhad visit our risks dashboard for free.

In addition, Hap Seng Plantations Holdings Berhad has been paying dividends over a period of at least ten years suggesting that keeping up dividend payments is way more important to the management even if it comes at the cost of business growth. Our latest analyst data shows that the future payout ratio of the company is expected to drop to 60% over the next three years. However, Hap Seng Plantations Holdings Berhad's future ROE is expected to decline to 2.5% despite the expected decline in its payout ratio. We infer that there could be other factors that could be steering the foreseen decline in the company's ROE.

Conclusion

On the whole, Hap Seng Plantations Holdings Berhad's performance is quite a big let-down. The company has seen a lack of earnings growth as a result of retaining very little profits and whatever little it does retain, is being reinvested at a very low rate of return. That being so, the latest industry analyst forecasts show that the analysts are expecting to see a huge improvement in the company's earnings growth rate. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

When trading Hap Seng Plantations Holdings Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Hap Seng Plantations Holdings Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hap Seng Plantations Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:HSPLANT

Hap Seng Plantations Holdings Berhad

An investment holding company, operates as an oil palm plantation company in Malaysia.

Flawless balance sheet, undervalued and pays a dividend.