Does Hap Seng Plantations Holdings Berhad (KLSE:HSPLANT) Deserve A Spot On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In contrast to all that, I prefer to spend time on companies like Hap Seng Plantations Holdings Berhad (KLSE:HSPLANT), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Hap Seng Plantations Holdings Berhad

How Fast Is Hap Seng Plantations Holdings Berhad Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. Hap Seng Plantations Holdings Berhad managed to grow EPS by 7.8% per year, over three years. While that sort of growth rate isn't amazing, it does show the business is growing.

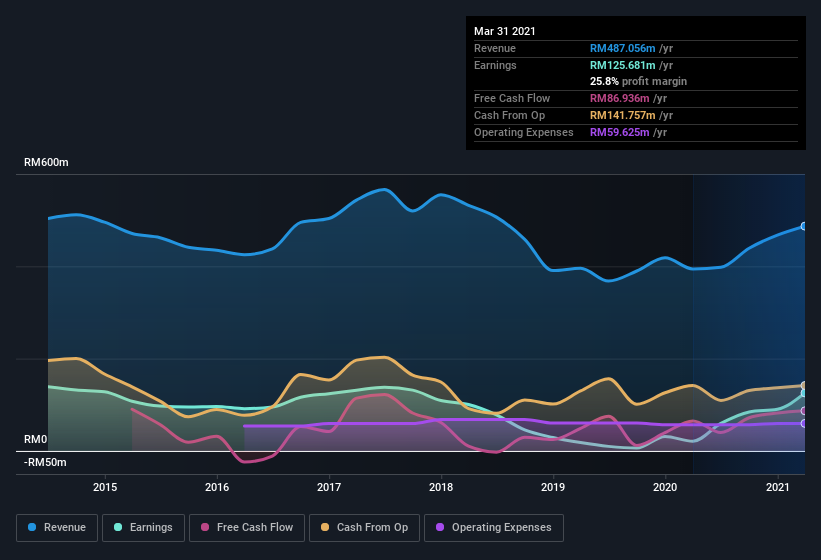

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Hap Seng Plantations Holdings Berhad is growing revenues, and EBIT margins improved by 25.8 percentage points to 32%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Hap Seng Plantations Holdings Berhad.

Are Hap Seng Plantations Holdings Berhad Insiders Aligned With All Shareholders?

I always like to check up on CEO compensation, because I think that reasonable pay levels, around or below the median, can be a sign that shareholder interests are well considered. For companies with market capitalizations between RM822m and RM3.3b, like Hap Seng Plantations Holdings Berhad, the median CEO pay is around RM1.3m.

Hap Seng Plantations Holdings Berhad offered total compensation worth RM791k to its CEO in the year to . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Should You Add Hap Seng Plantations Holdings Berhad To Your Watchlist?

One positive for Hap Seng Plantations Holdings Berhad is that it is growing EPS. That's nice to see. On top of that, my faith in the board of directors is strengthened by the fact of the reasonable CEO pay. So I do think the stock deserves further research, if not instant addition to your watchlist. We don't want to rain on the parade too much, but we did also find 2 warning signs for Hap Seng Plantations Holdings Berhad (1 is a bit unpleasant!) that you need to be mindful of.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Hap Seng Plantations Holdings Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hap Seng Plantations Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:HSPLANT

Hap Seng Plantations Holdings Berhad

An investment holding company, operates as an oil palm plantation company in Malaysia.

Flawless balance sheet, undervalued and pays a dividend.