C.I. Holdings Berhad Full Year 2024 Earnings: EPS: RM0.42 (vs RM0.62 in FY 2023)

C.I. Holdings Berhad (KLSE:CIHLDG) Full Year 2024 Results

Key Financial Results

- Revenue: RM3.90b (down 27% from FY 2023).

- Net income: RM68.7m (down 32% from FY 2023).

- Profit margin: 1.8% (down from 1.9% in FY 2023). The decrease in margin was driven by lower revenue.

- EPS: RM0.42 (down from RM0.62 in FY 2023).

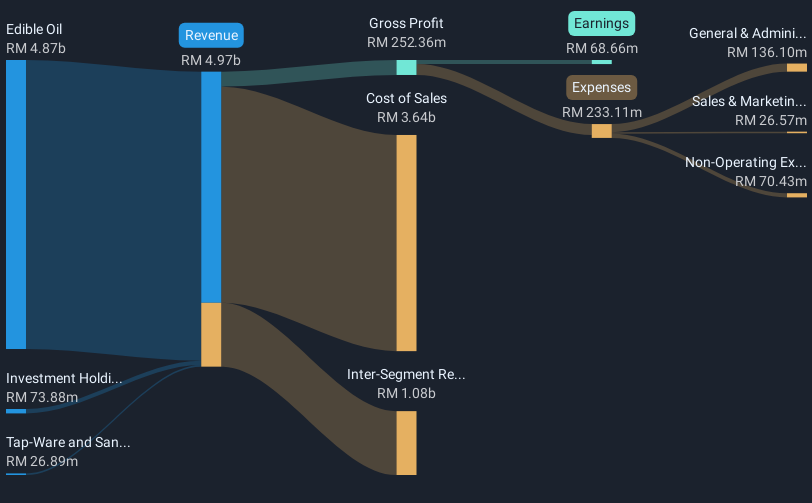

All figures shown in the chart above are for the trailing 12 month (TTM) period

The primary driver behind last 12 months revenue was the Edible Oil segment contributing a total revenue of RM4.87b (125% of total revenue). Notably, cost of sales worth RM3.64b amounted to 94% of total revenue thereby underscoring the impact on earnings. The largest operating expense was General & Administrative costs, amounting to RM136.1m (74% of total expenses). Explore how CIHLDG's revenue and expenses shape its earnings.

C.I. Holdings Berhad shares are down 1.4% from a week ago.

Risk Analysis

Be aware that C.I. Holdings Berhad is showing 1 warning sign in our investment analysis that you should know about...

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:CIHLDG

C.I. Holdings Berhad

An investment holding company, engages in manufacturing, selling, and packing various types of edible oils in Malaysia, Africa, Asia, and internationally.

Good value with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026