CCK Consolidated Holdings Berhad (KLSE:CCK) Shares Fly 26% But Investors Aren't Buying For Growth

CCK Consolidated Holdings Berhad (KLSE:CCK) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. The last month tops off a massive increase of 111% in the last year.

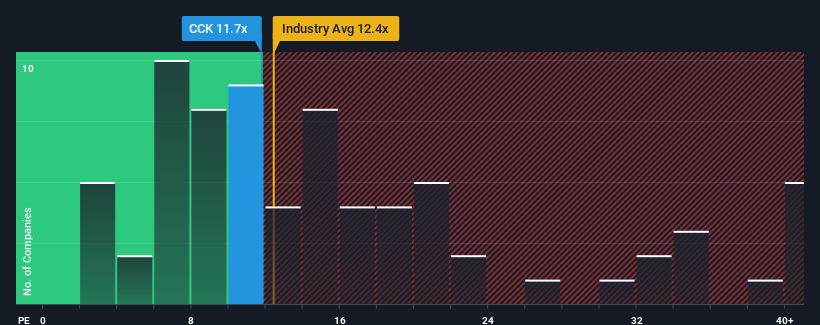

In spite of the firm bounce in price, CCK Consolidated Holdings Berhad may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 11.7x, since almost half of all companies in Malaysia have P/E ratios greater than 17x and even P/E's higher than 30x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for CCK Consolidated Holdings Berhad as its earnings have been rising faster than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for CCK Consolidated Holdings Berhad

How Is CCK Consolidated Holdings Berhad's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as CCK Consolidated Holdings Berhad's is when the company's growth is on track to lag the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 24% last year. Pleasingly, EPS has also lifted 178% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to slump, contracting by 0.2% each year during the coming three years according to the dual analysts following the company. With the market predicted to deliver 14% growth each year, that's a disappointing outcome.

With this information, we are not surprised that CCK Consolidated Holdings Berhad is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

CCK Consolidated Holdings Berhad's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of CCK Consolidated Holdings Berhad's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 1 warning sign for CCK Consolidated Holdings Berhad that we have uncovered.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:CCK

CCK Consolidated Holdings Berhad

An investment holding company, engages in the rearing and production of poultry products, prawns, and seafood products.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives