A Quick Analysis On Can-One Berhad's (KLSE:CANONE) CEO Salary

Marc Francis Yeoh became the CEO of Can-One Berhad (KLSE:CANONE) in 2017, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also assess whether Can-One Berhad pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

View our latest analysis for Can-One Berhad

How Does Total Compensation For Marc Francis Yeoh Compare With Other Companies In The Industry?

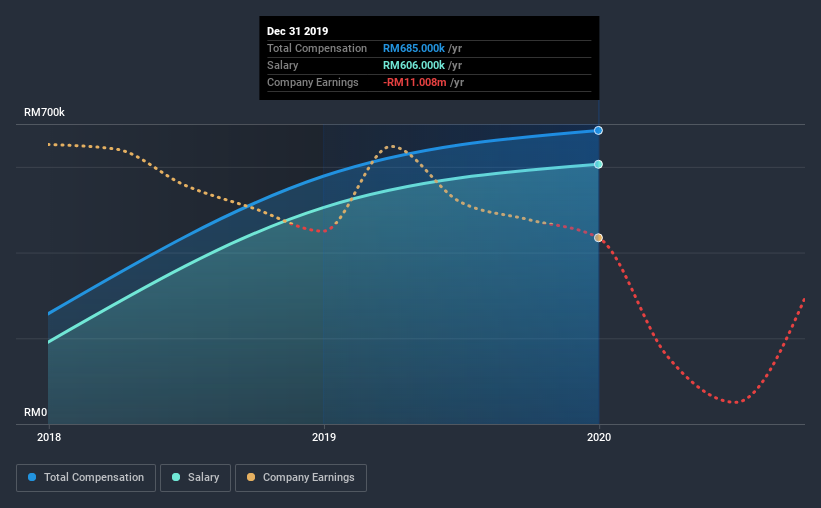

Our data indicates that Can-One Berhad has a market capitalization of RM528m, and total annual CEO compensation was reported as RM685k for the year to December 2019. We note that's an increase of 19% above last year. We note that the salary portion, which stands at RM606.0k constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the industry with market capitalizations under RM815m, the reported median total CEO compensation was RM663k. So it looks like Can-One Berhad compensates Marc Francis Yeoh in line with the median for the industry. What's more, Marc Francis Yeoh holds RM937k worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | RM606k | RM505k | 88% |

| Other | RM79k | RM73k | 12% |

| Total Compensation | RM685k | RM578k | 100% |

Speaking on an industry level, nearly 76% of total compensation represents salary, while the remainder of 24% is other remuneration. Can-One Berhad is paying a higher share of its remuneration through a salary in comparison to the overall industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Can-One Berhad's Growth

Over the last three years, Can-One Berhad has shrunk its earnings per share by 115% per year. Its revenue is up 34% over the last year.

Investors would be a bit wary of companies that have lower EPS On the other hand, the strong revenue growth suggests the business is growing. It's hard to reach a conclusion about business performance right now. This may be one to watch. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Can-One Berhad Been A Good Investment?

Can-One Berhad has not done too badly by shareholders, with a total return of 7.2%, over three years. But they would probably prefer not to see CEO compensation far in excess of the median.

To Conclude...

As we touched on above, Can-One Berhad is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. But revenue growth over the last year can't be ignored. That's why we were hoping for more robust shareholder returns at this time. EPS growth is a further sore spot — the metric is negative over the last three years. We wouldn't say compensation is inappropriate considering the stable performance, but shareholders might want to see some better numbers before warming to the idea of a bump.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 2 warning signs for Can-One Berhad that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading Can-One Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:CANONE

Can-One Berhad

An investment holding company, manufactures and sells metal and lithographed tin cans, plastic jerry cans, rigid packaging products, aluminum cans, and corrugated fiberboard cartons in Malaysia, Vietnam, Singapore, Myanmar, Indonesia, and the United States of America.

Good value with acceptable track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026