- Malaysia

- /

- Metals and Mining

- /

- KLSE:AUMAS

We Think Bahvest Resources Berhad (KLSE:BAHVEST) Has A Fair Chunk Of Debt

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Bahvest Resources Berhad (KLSE:BAHVEST) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Bahvest Resources Berhad

What Is Bahvest Resources Berhad's Debt?

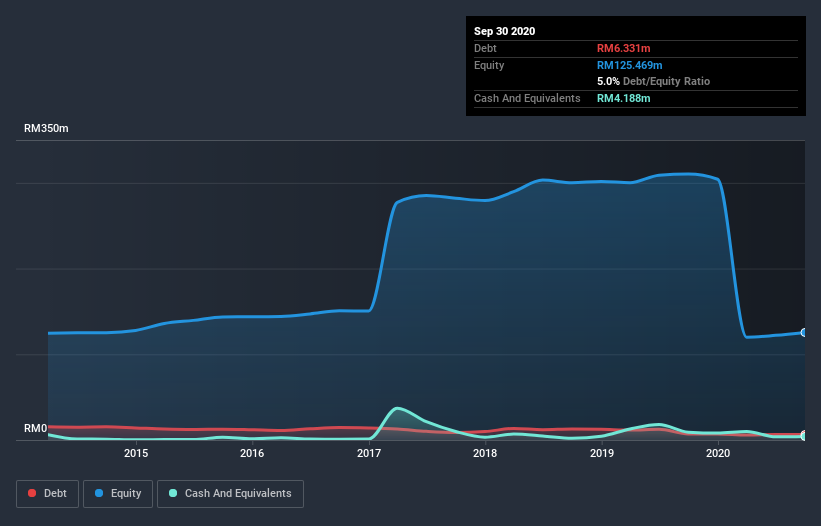

The image below, which you can click on for greater detail, shows that Bahvest Resources Berhad had debt of RM6.33m at the end of September 2020, a reduction from RM6.99m over a year. However, it does have RM4.19m in cash offsetting this, leading to net debt of about RM2.14m.

How Strong Is Bahvest Resources Berhad's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Bahvest Resources Berhad had liabilities of RM27.2m due within 12 months and liabilities of RM13.3m due beyond that. Offsetting this, it had RM4.19m in cash and RM9.62m in receivables that were due within 12 months. So it has liabilities totalling RM26.7m more than its cash and near-term receivables, combined.

Since publicly traded Bahvest Resources Berhad shares are worth a total of RM677.2m, it seems unlikely that this level of liabilities would be a major threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. Carrying virtually no net debt, Bahvest Resources Berhad has a very light debt load indeed. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Bahvest Resources Berhad will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Bahvest Resources Berhad had a loss before interest and tax, and actually shrunk its revenue by 12%, to RM93m. That's not what we would hope to see.

Caveat Emptor

Not only did Bahvest Resources Berhad's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). To be specific the EBIT loss came in at RM19m. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. Another cause for caution is that is bled RM4.5m in negative free cash flow over the last twelve months. So suffice it to say we do consider the stock to be risky. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 1 warning sign for Bahvest Resources Berhad that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you’re looking to trade Bahvest Resources Berhad, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:AUMAS

AuMas Resources Berhad

An investment holding company, engages in gold mining business in Malaysia.

Flawless balance sheet with solid track record.