- Malaysia

- /

- Metals and Mining

- /

- KLSE:AUMAS

Investors Will Want Bahvest Resources Berhad's (KLSE:BAHVEST) Growth In ROCE To Persist

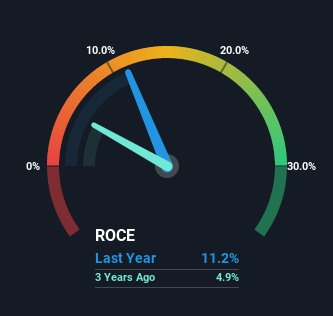

If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. So on that note, Bahvest Resources Berhad (KLSE:BAHVEST) looks quite promising in regards to its trends of return on capital.

Understanding Return On Capital Employed (ROCE)

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on Bahvest Resources Berhad is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.11 = RM15m ÷ (RM173m - RM36m) (Based on the trailing twelve months to December 2022).

Therefore, Bahvest Resources Berhad has an ROCE of 11%. In absolute terms, that's a satisfactory return, but compared to the Food industry average of 9.0% it's much better.

Check out our latest analysis for Bahvest Resources Berhad

Historical performance is a great place to start when researching a stock so above you can see the gauge for Bahvest Resources Berhad's ROCE against it's prior returns. If you want to delve into the historical earnings, revenue and cash flow of Bahvest Resources Berhad, check out these free graphs here.

So How Is Bahvest Resources Berhad's ROCE Trending?

Like most people, we're pleased that Bahvest Resources Berhad is now generating some pretax earnings. While the business is profitable now, it used to be incurring losses on invested capital five years ago. In regards to capital employed, Bahvest Resources Berhad is using 52% less capital than it was five years ago, which on the surface, can indicate that the business has become more efficient at generating these returns. This could potentially mean that the company is selling some of its assets.

For the record though, there was a noticeable increase in the company's current liabilities over the period, so we would attribute some of the ROCE growth to that. The current liabilities has increased to 21% of total assets, so the business is now more funded by the likes of its suppliers or short-term creditors. It's worth keeping an eye on this because as the percentage of current liabilities to total assets increases, some aspects of risk also increase.

In Conclusion...

In the end, Bahvest Resources Berhad has proven it's capital allocation skills are good with those higher returns from less amount of capital. Given the stock has declined 61% in the last five years, this could be a good investment if the valuation and other metrics are also appealing. That being the case, research into the company's current valuation metrics and future prospects seems fitting.

One final note, you should learn about the 2 warning signs we've spotted with Bahvest Resources Berhad (including 1 which is significant) .

While Bahvest Resources Berhad may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:AUMAS

AuMas Resources Berhad

An investment holding company, engages in gold mining business in Malaysia.

Flawless balance sheet with solid track record.