- Malaysia

- /

- Energy Services

- /

- KLSE:YINSON

While shareholders of Yinson Holdings Berhad (KLSE:YINSON) are in the red over the last five years, underlying earnings have actually grown

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But in any portfolio, there will be mixed results between individual stocks. So we wouldn't blame long term Yinson Holdings Berhad (KLSE:YINSON) shareholders for doubting their decision to hold, with the stock down 28% over a half decade. And we doubt long term believers are the only worried holders, since the stock price has declined 24% over the last twelve months. Shareholders have had an even rougher run lately, with the share price down 21% in the last 90 days.

The recent uptick of 4.5% could be a positive sign of things to come, so let's take a look at historical fundamentals.

Our free stock report includes 1 warning sign investors should be aware of before investing in Yinson Holdings Berhad. Read for free now.In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the unfortunate half decade during which the share price slipped, Yinson Holdings Berhad actually saw its earnings per share (EPS) improve by 18% per year. So it doesn't seem like EPS is a great guide to understanding how the market is valuing the stock. Or possibly, the market was previously very optimistic, so the stock has disappointed, despite improving EPS.

Due to the lack of correlation between the EPS growth and the falling share price, it's worth taking a look at other metrics to try to understand the share price movement.

We don't think that the 1.6% is big factor in the share price, since it's quite small, as dividends go. Revenue is actually up 24% over the time period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

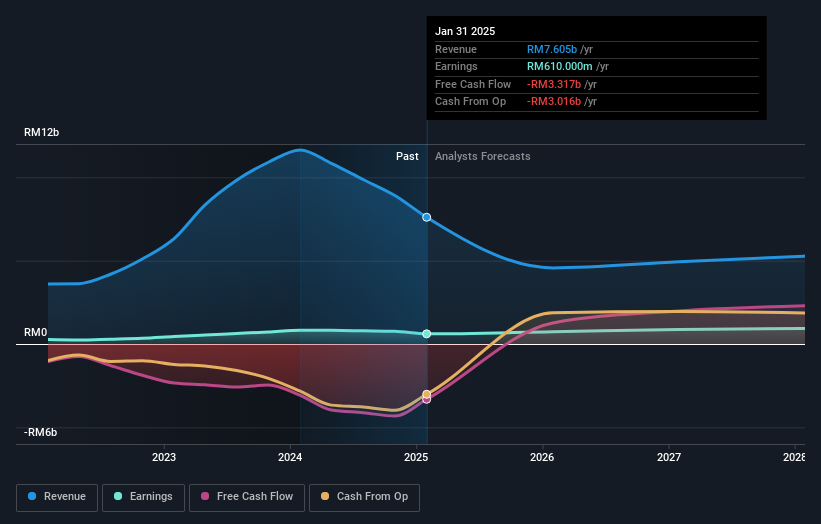

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at Yinson Holdings Berhad's financial health with this free report on its balance sheet.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Yinson Holdings Berhad the TSR over the last 5 years was -12%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While the broader market lost about 3.7% in the twelve months, Yinson Holdings Berhad shareholders did even worse, losing 22% (even including dividends). However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 2% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Yinson Holdings Berhad better, we need to consider many other factors. Even so, be aware that Yinson Holdings Berhad is showing 1 warning sign in our investment analysis , you should know about...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

If you're looking to trade Yinson Holdings Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:YINSON

Yinson Holdings Berhad

An investment holding company, operates as a floating, production, storage, and offloading (FPSO) service provider.

Undervalued with acceptable track record.

Market Insights

Community Narratives