- Malaysia

- /

- Energy Services

- /

- KLSE:SAPNRG

The Market Lifts Sapura Energy Berhad (KLSE:SAPNRG) Shares 38% But It Can Do More

Despite an already strong run, Sapura Energy Berhad (KLSE:SAPNRG) shares have been powering on, with a gain of 38% in the last thirty days. Unfortunately, despite the strong performance over the last month, the full year gain of 10.0% isn't as attractive.

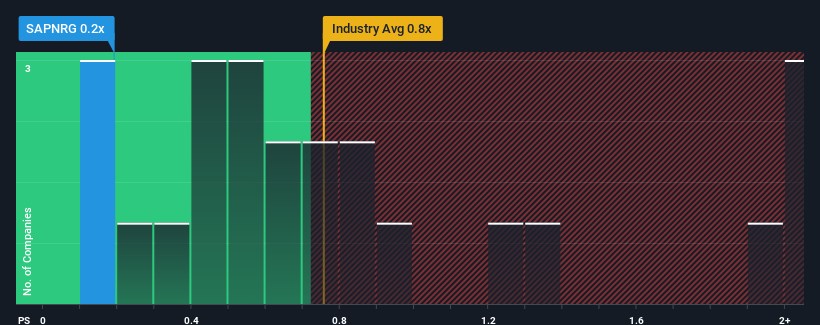

Even after such a large jump in price, when close to half the companies operating in Malaysia's Energy Services industry have price-to-sales ratios (or "P/S") above 0.8x, you may still consider Sapura Energy Berhad as an enticing stock to check out with its 0.2x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Sapura Energy Berhad

How Sapura Energy Berhad Has Been Performing

Recent times haven't been great for Sapura Energy Berhad as its revenue has been rising slower than most other companies. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Sapura Energy Berhad.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Sapura Energy Berhad's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company grew revenue by an impressive 31% last year. However, this wasn't enough as the latest three year period has seen the company endure a nasty 25% drop in revenue in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should demonstrate some strength in company's business, generating growth of 3.9% as estimated by the four analysts watching the company. Meanwhile, the broader industry is forecast to contract by 3.7%, which would indicate the company is doing better than the majority of its peers.

With this in consideration, we find it intriguing that Sapura Energy Berhad's P/S falls short of its industry peers. Apparently some shareholders are doubtful of the contrarian forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Sapura Energy Berhad's P/S?

The latest share price surge wasn't enough to lift Sapura Energy Berhad's P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Sapura Energy Berhad's analyst forecasts revealed that its superior revenue outlook against a shaky industry isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major unobserved threats to revenue preventing the P/S ratio from matching the positive outlook. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. It appears many are indeed anticipating revenue instability, because the company's current prospects should normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 3 warning signs for Sapura Energy Berhad you should be aware of, and 2 of them are a bit unpleasant.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:SAPNRG

Sapura Energy Berhad

An investment holding company, offers integrated energy services and solutions in Malaysia, Australia, Africa, the Americas, the Middle East, Asia, and internationally.

Moderate and fair value.

Similar Companies

Market Insights

Community Narratives