- Malaysia

- /

- Energy Services

- /

- KLSE:SAPNRG

Revenues Not Telling The Story For Sapura Energy Berhad (KLSE:SAPNRG)

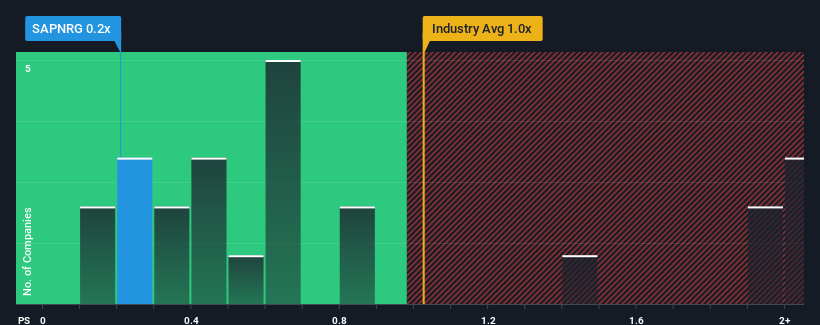

With a median price-to-sales (or "P/S") ratio of close to 0.7x in the Energy Services industry in Malaysia, you could be forgiven for feeling indifferent about Sapura Energy Berhad's (KLSE:SAPNRG) P/S ratio of 0.2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Sapura Energy Berhad

How Sapura Energy Berhad Has Been Performing

Recent times haven't been great for Sapura Energy Berhad as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Sapura Energy Berhad will help you uncover what's on the horizon.How Is Sapura Energy Berhad's Revenue Growth Trending?

Sapura Energy Berhad's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 17%. However, this wasn't enough as the latest three year period has seen the company endure a nasty 12% drop in revenue in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to plummet, contracting by 8.6% during the coming year according to the three analysts following the company. With the rest of the industry predicted to shrink by 6.1%, it's a sub-optimal result.

In light of this, it's somewhat peculiar that Sapura Energy Berhad's P/S sits in line with the majority of other companies. When revenue shrink rapidly the P/S often shrinks too, which could set up shareholders for future disappointment. There's potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Sapura Energy Berhad's P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Sapura Energy Berhad's analyst forecasts have revealed that its even shakier outlook against the industry isn't impacting its P/S as much as we would have predicted. Even though the company's P/S is on par with the rest of the industry, the fact that it's revenue outlook is poorer than an already struggling industry suggests that the P/S isn't justified. We're also cautious about the company's ability to resist even greater pain to its business from the broader industry turmoil. This presents a risk to investors if the P/S were to decline to a level that more accurately reflects the company's revenue prospects.

Before you take the next step, you should know about the 4 warning signs for Sapura Energy Berhad (2 are a bit concerning!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Sapura Energy Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:SAPNRG

Sapura Energy Berhad

An investment holding company, offers integrated energy services and solutions in Malaysia, Australia, Africa, the Americas, the Middle East, Asia, and internationally.

Fair value with moderate growth potential.