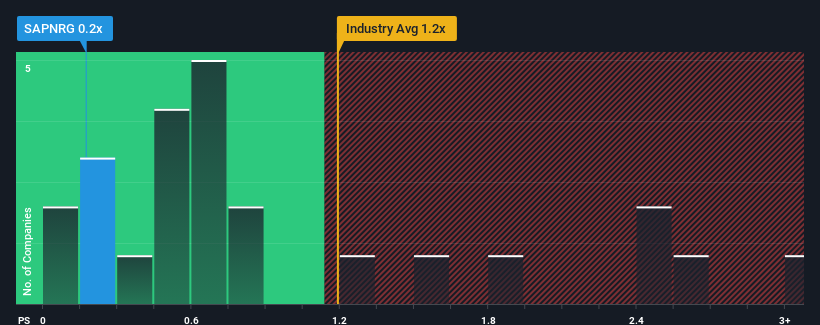

Sapura Energy Berhad's (KLSE:SAPNRG) price-to-sales (or "P/S") ratio of 0.2x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Energy Services industry in Malaysia have P/S ratios greater than 0.7x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Sapura Energy Berhad

How Sapura Energy Berhad Has Been Performing

Sapura Energy Berhad hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Sapura Energy Berhad will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Sapura Energy Berhad's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 6.5% decrease to the company's top line. As a result, revenue from three years ago have also fallen 20% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue growth will show minor resilience over the next three years growing only by 1.9% per year. This isn't typically strong growth, but with the rest of the industry predicted to shrink by 11% per annum, that would be a solid result.

With this information, we find it very odd that Sapura Energy Berhad is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the contrarian forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Sapura Energy Berhad's P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Sapura Energy Berhad's analyst forecasts has shown that it could be trading at a significant discount in terms of P/S, as it is expected to far outperform the industry. We believe there could be some underlying risks that are keeping the P/S modest in the context of above-average revenue growth. Amidst challenging industry conditions, a key concern is whether the company can sustain its superior revenue growth trajectory. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Before you take the next step, you should know about the 4 warning signs for Sapura Energy Berhad (2 don't sit too well with us!) that we have uncovered.

If you're unsure about the strength of Sapura Energy Berhad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Sapura Energy Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:SAPNRG

Sapura Energy Berhad

An investment holding company, offers integrated energy services and solutions in Malaysia, Australia, Africa, the Americas, the Middle East, Asia, and internationally.

Fair value with moderate growth potential.