- Malaysia

- /

- Energy Services

- /

- KLSE:PERDANA

Risks To Shareholder Returns Are Elevated At These Prices For Perdana Petroleum Berhad (KLSE:PERDANA)

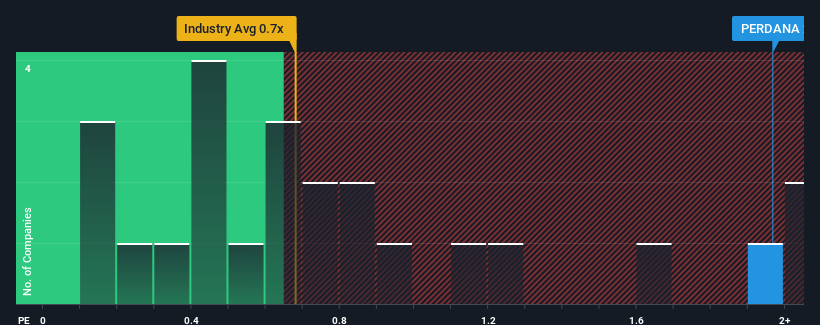

When close to half the companies in the Energy Services industry in Malaysia have price-to-sales ratios (or "P/S") below 0.7x, you may consider Perdana Petroleum Berhad (KLSE:PERDANA) as a stock to potentially avoid with its 2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Perdana Petroleum Berhad

How Perdana Petroleum Berhad Has Been Performing

Perdana Petroleum Berhad has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Perdana Petroleum Berhad's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as high as Perdana Petroleum Berhad's is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company grew revenue by an impressive 19% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 28% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Comparing that to the industry, which is predicted to shrink 3.5% in the next 12 months, the company's downward momentum is still inferior based on recent medium-term annualised revenue results.

In light of this, it's odd that Perdana Petroleum Berhad's P/S sits above the majority of other companies. In general, when revenue shrink rapidly the P/S premium often shrinks too, which could set up shareholders for future disappointment. Maintaining these prices will be extremely difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Perdana Petroleum Berhad revealed its sharp three-year contraction in revenue isn't impacting its high P/S anywhere near as much as we would have predicted, given the industry is set to shrink less severely. When we see below average revenue, we suspect the share price is at risk of declining, sending the high P/S lower. In addition, we would be concerned whether the company can even maintain its medium-term level of performance under these tough industry conditions. This would place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It is also worth noting that we have found 2 warning signs for Perdana Petroleum Berhad that you need to take into consideration.

If you're unsure about the strength of Perdana Petroleum Berhad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:PERDANA

Perdana Petroleum Berhad

An investment holding company, provides offshore marine support services for the upstream oil and gas industry in Malaysia.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives