- Malaysia

- /

- Energy Services

- /

- KLSE:PERDANA

Perdana Petroleum Berhad (KLSE:PERDANA) Stocks Shoot Up 28% But Its P/S Still Looks Reasonable

Perdana Petroleum Berhad (KLSE:PERDANA) shares have had a really impressive month, gaining 28% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 31% in the last year.

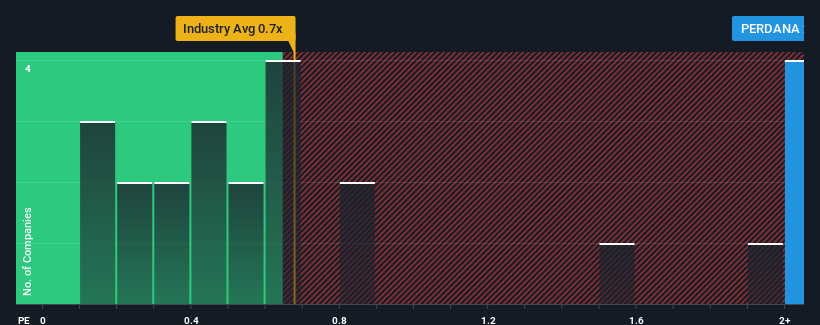

Following the firm bounce in price, you could be forgiven for thinking Perdana Petroleum Berhad is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.1x, considering almost half the companies in Malaysia's Energy Services industry have P/S ratios below 0.7x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Perdana Petroleum Berhad

How Perdana Petroleum Berhad Has Been Performing

Recent times have been quite advantageous for Perdana Petroleum Berhad as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Perdana Petroleum Berhad's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as high as Perdana Petroleum Berhad's is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company grew revenue by an impressive 46% last year. As a result, it also grew revenue by 14% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

In contrast to the company, the rest of the industry is expected to decline by 6.3% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

With this in mind, it's clear to us why Perdana Petroleum Berhad's P/S exceeds that of its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the industry. Nonetheless, with most other businesses facing an uphill battle, staying on its current revenue path is no certainty.

The Final Word

The large bounce in Perdana Petroleum Berhad's shares has lifted the company's P/S handsomely. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As detailed previously, the strength of Perdana Petroleum Berhad's recent revenue trends over the medium-term relative to a declining industry is part of the reason why it trades at a higher P/S than its industry counterparts. It could be said that investors feel this revenue growth will continue into the future, justifying a higher P/S ratio. Our only concern is whether its revenue trajectory can keep outperforming under these tough industry conditions. Otherwise, it's hard to see the share price falling strongly in the near future if its revenue performance persists.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Perdana Petroleum Berhad that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Perdana Petroleum Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:PERDANA

Perdana Petroleum Berhad

An investment holding company, provides offshore marine support services for the upstream oil and gas industry in Malaysia.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives