- Malaysia

- /

- Energy Services

- /

- KLSE:PENERGY

How Much Is Petra Energy Berhad (KLSE:PENERGY) CEO Getting Paid?

This article will reflect on the compensation paid to Anthony Bin Bujang who has served as CEO of Petra Energy Berhad (KLSE:PENERGY) since 2012. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Petra Energy Berhad.

View our latest analysis for Petra Energy Berhad

Comparing Petra Energy Berhad's CEO Compensation With the industry

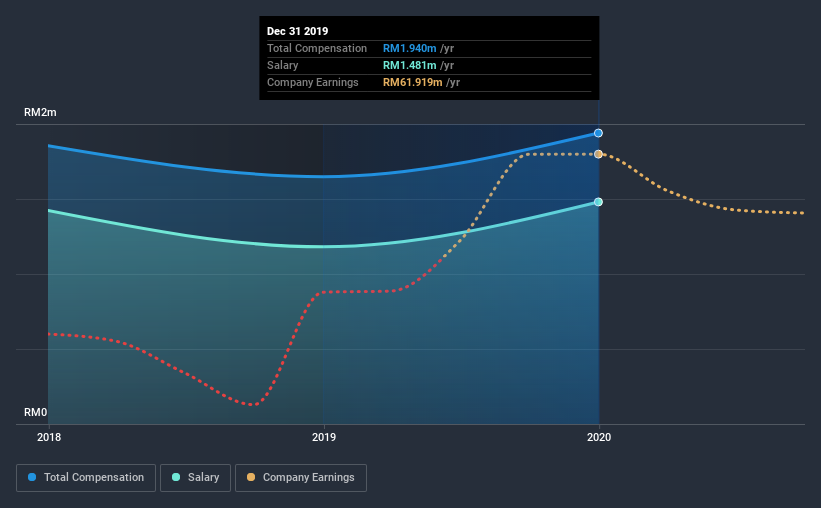

Our data indicates that Petra Energy Berhad has a market capitalization of RM363m, and total annual CEO compensation was reported as RM1.9m for the year to December 2019. Notably, that's an increase of 18% over the year before. We note that the salary portion, which stands at RM1.48m constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the industry with market capitalizations below RM811m, reported a median total CEO compensation of RM1.4m. Accordingly, our analysis reveals that Petra Energy Berhad pays Anthony Bin Bujang north of the industry median.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | RM1.5m | RM1.2m | 76% |

| Other | RM459k | RM467k | 24% |

| Total Compensation | RM1.9m | RM1.6m | 100% |

On an industry level, around 82% of total compensation represents salary and 18% is other remuneration. There isn't a significant difference between Petra Energy Berhad and the broader market, in terms of salary allocation in the overall compensation package. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Petra Energy Berhad's Growth Numbers

Over the past three years, Petra Energy Berhad has seen its earnings per share (EPS) grow by 99% per year. It saw its revenue drop 40% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's always a tough situation when revenues are not growing, but ultimately profits are more important. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Petra Energy Berhad Been A Good Investment?

Boasting a total shareholder return of 42% over three years, Petra Energy Berhad has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

As previously discussed, Anthony is compensated more than what is normal for CEOs of companies of similar size, and which belong to the same industry. Importantly though, EPS growth and shareholder returns are very impressive over the last three years. So, in acknowledgment of the overall excellent performance, we believe CEO compensation is appropriate. The pleasing shareholder returns are the cherry on top. We wouldn't be wrong in saying that shareholders feel that Anthony's performance creates value for the company.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We've identified 3 warning signs for Petra Energy Berhad that investors should be aware of in a dynamic business environment.

Important note: Petra Energy Berhad is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

When trading Petra Energy Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:PENERGY

Petra Energy Berhad

An investment holding company, engages in the provision of a range of integrated brownfield services and products for the upstream oil and gas industry in Malaysia.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives