- Malaysia

- /

- Energy Services

- /

- KLSE:M&G

Does Marine & General Berhad (KLSE:M&G) Have A Healthy Balance Sheet?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Marine & General Berhad (KLSE:M&G) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Marine & General Berhad

What Is Marine & General Berhad's Debt?

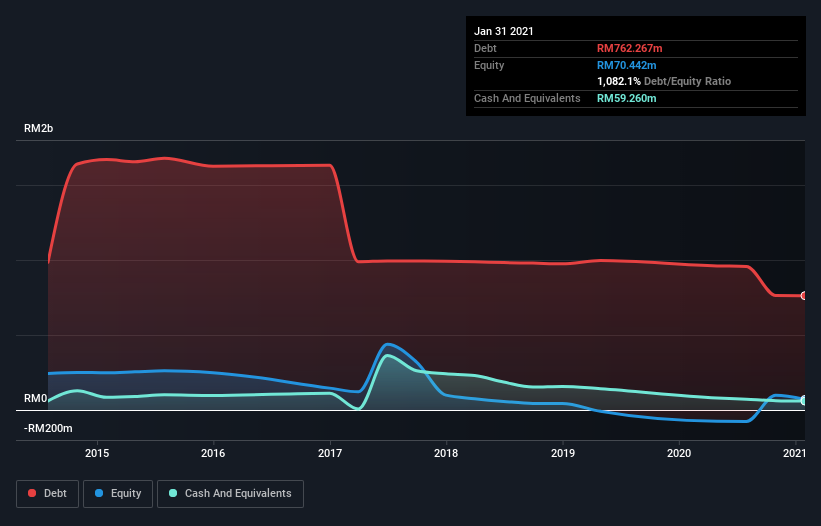

You can click the graphic below for the historical numbers, but it shows that Marine & General Berhad had RM762.3m of debt in January 2021, down from RM960.5m, one year before. However, it also had RM59.3m in cash, and so its net debt is RM703.0m.

How Healthy Is Marine & General Berhad's Balance Sheet?

We can see from the most recent balance sheet that Marine & General Berhad had liabilities of RM90.8m falling due within a year, and liabilities of RM714.6m due beyond that. Offsetting this, it had RM59.3m in cash and RM31.5m in receivables that were due within 12 months. So it has liabilities totalling RM714.6m more than its cash and near-term receivables, combined.

This deficit casts a shadow over the RM86.9m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, Marine & General Berhad would likely require a major re-capitalisation if it had to pay its creditors today. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Marine & General Berhad will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Marine & General Berhad made a loss at the EBIT level, and saw its revenue drop to RM197m, which is a fall of 3.6%. That's not what we would hope to see.

Caveat Emptor

Importantly, Marine & General Berhad had an earnings before interest and tax (EBIT) loss over the last year. Indeed, it lost a very considerable RM53m at the EBIT level. Reflecting on this and the significant total liabilities, it's hard to know what to say about the stock because of our intense dis-affinity for it. Like every long-shot we're sure it has a glossy presentation outlining its blue-sky potential. But on the bright side the company actually produced a statutory profit of RM1.3m and free cash flow of RM16m. So while its ongoing EBIT might disappoint, it has a fair bit going for it! There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 4 warning signs we've spotted with Marine & General Berhad (including 1 which is potentially serious) .

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:M&G

Marine & General Berhad

An investment holding company, provides offshore marine support services for the upstream and downstream oil and gas industry in Malaysia.

Good value with mediocre balance sheet.

Market Insights

Community Narratives