- Malaysia

- /

- Oil and Gas

- /

- KLSE:KUB

Increases to CEO Compensation Might Be Put On Hold For Now at KUB Malaysia Berhad (KLSE:KUB)

Performance at KUB Malaysia Berhad (KLSE:KUB) has been reasonably good and CEO Ahmed bin Abdul Aziz has done a decent job of steering the company in the right direction. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 27 October 2022. However, some shareholders may still want to keep CEO compensation within reason.

Check out the opportunities and risks within the MY Oil and Gas industry.

Comparing KUB Malaysia Berhad's CEO Compensation With The Industry

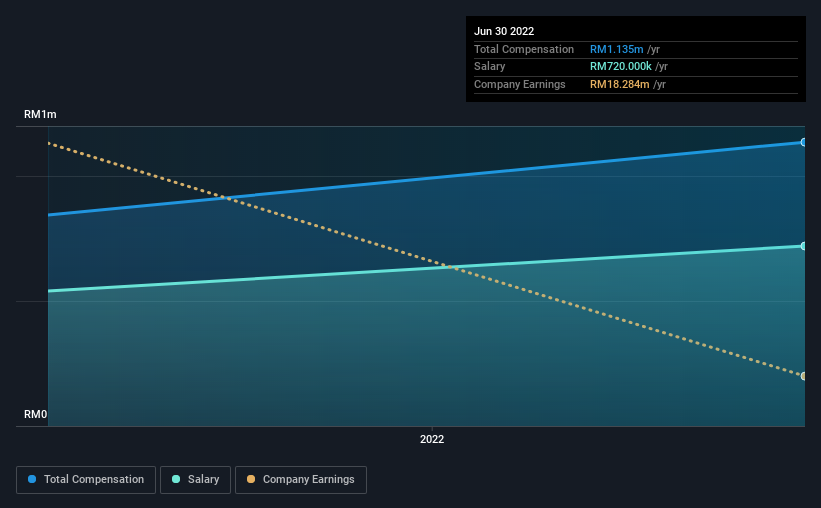

Our data indicates that KUB Malaysia Berhad has a market capitalization of RM309m, and total annual CEO compensation was reported as RM1.1m for the year to June 2022. That's a notable increase of 34% on last year. We note that the salary portion, which stands at RM720.0k constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the industry with market capitalizations under RM945m, the reported median total CEO compensation was RM867k. Accordingly, our analysis reveals that KUB Malaysia Berhad pays Ahmed bin Abdul Aziz north of the industry median.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | RM720k | RM540k | 63% |

| Other | RM415k | RM304k | 37% |

| Total Compensation | RM1.1m | RM844k | 100% |

On an industry level, roughly 76% of total compensation represents salary and 24% is other remuneration. It's interesting to note that KUB Malaysia Berhad allocates a smaller portion of compensation to salary in comparison to the broader industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

KUB Malaysia Berhad's Growth

KUB Malaysia Berhad's earnings per share (EPS) grew 58% per year over the last three years. It achieved revenue growth of 41% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. Most shareholders would be pleased to see strong revenue growth combined with EPS growth. This combo suggests a fast growing business. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has KUB Malaysia Berhad Been A Good Investment?

Boasting a total shareholder return of 82% over three years, KUB Malaysia Berhad has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. However, any decision to raise CEO pay might be met with some objections from the shareholders given that the CEO is already paid higher than the industry average.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We identified 4 warning signs for KUB Malaysia Berhad (1 is concerning!) that you should be aware of before investing here.

Important note: KUB Malaysia Berhad is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if KUB Malaysia Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:KUB

KUB Malaysia Berhad

An investment holding company, engages in the business of importing, storing, bottling, marketing, trading, and distributing liquefied petroleum gas (LPG) for household and industrial use under the Solar Gas brand name in Malaysia.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives