- Malaysia

- /

- Energy Services

- /

- KLSE:LFG

After Leaping 28% Icon Offshore Berhad (KLSE:ICON) Shares Are Not Flying Under The Radar

Icon Offshore Berhad (KLSE:ICON) shareholders have had their patience rewarded with a 28% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 36%.

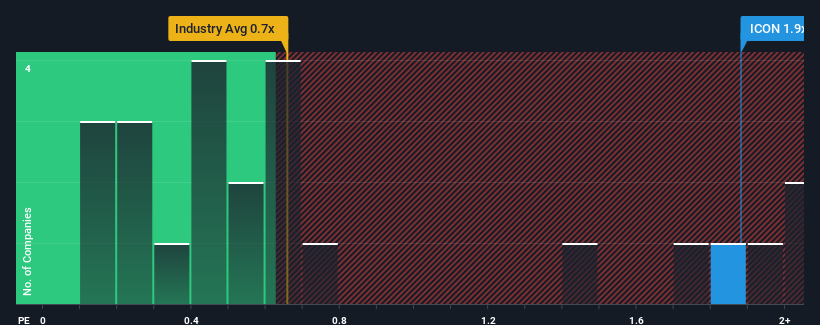

After such a large jump in price, when almost half of the companies in Malaysia's Energy Services industry have price-to-sales ratios (or "P/S") below 0.7x, you may consider Icon Offshore Berhad as a stock probably not worth researching with its 1.9x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Icon Offshore Berhad

What Does Icon Offshore Berhad's Recent Performance Look Like?

Icon Offshore Berhad hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Icon Offshore Berhad's future stacks up against the industry? In that case, our free report is a great place to start.How Is Icon Offshore Berhad's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Icon Offshore Berhad's is when the company's growth is on track to outshine the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 29%. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue growth will be highly resilient over the next year growing by 12%. Meanwhile, the broader industry is forecast to contract by 6.4%, which would indicate the company is doing very well.

In light of this, it's understandable that Icon Offshore Berhad's P/S sits above the majority of other companies. Right now, investors are willing to pay more for a stock that is shaping up to buck the trend of the broader industry going backwards.

The Key Takeaway

The large bounce in Icon Offshore Berhad's shares has lifted the company's P/S handsomely. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we anticipated, our review of Icon Offshore Berhad's analyst forecasts shows that the company's better revenue forecast compared to a turbulent industry is a significant contributor to its high price-to-sales ratio. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. We still remain cautious about the company's ability to keep swimming against the current of the broader industry turmoil. Otherwise, it's hard to see the share price falling strongly in the near future under the current growth expectations.

We don't want to rain on the parade too much, but we did also find 5 warning signs for Icon Offshore Berhad (1 is potentially serious!) that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Lianson Fleet Group Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:LFG

Lianson Fleet Group Berhad

An investment holding company, provides offshore marine services to the oil and gas related industries in Malaysia and Brunei.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives