- Malaysia

- /

- Oil and Gas

- /

- KLSE:ELRIDGE

Elridge Energy Holdings Berhad's (KLSE:ELRIDGE) 27% Jump Shows Its Popularity With Investors

Despite an already strong run, Elridge Energy Holdings Berhad (KLSE:ELRIDGE) shares have been powering on, with a gain of 27% in the last thirty days. The annual gain comes to 132% following the latest surge, making investors sit up and take notice.

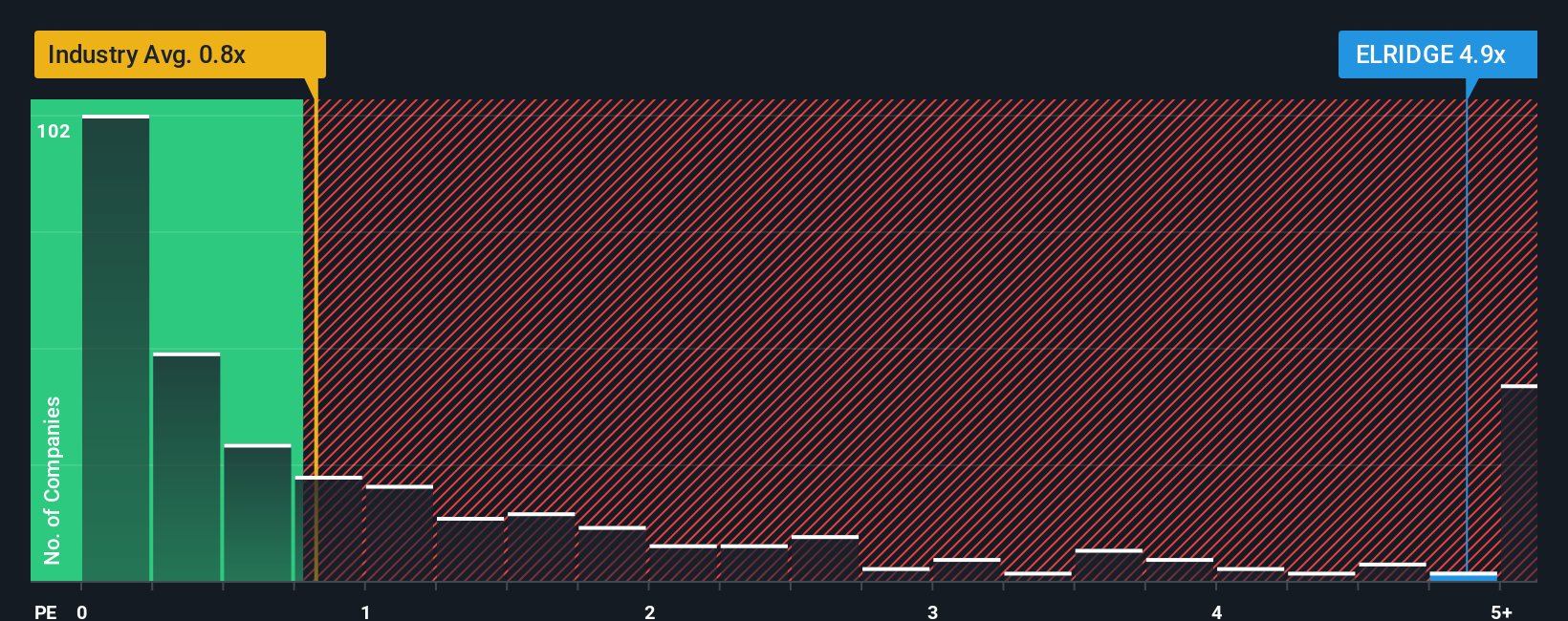

Since its price has surged higher, when almost half of the companies in Malaysia's Oil and Gas industry have price-to-sales ratios (or "P/S") below 0.5x, you may consider Elridge Energy Holdings Berhad as a stock not worth researching with its 4.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Elridge Energy Holdings Berhad

How Has Elridge Energy Holdings Berhad Performed Recently?

Elridge Energy Holdings Berhad certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. It seems that many are expecting the company to continue defying the broader industry adversity, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Elridge Energy Holdings Berhad.Do Revenue Forecasts Match The High P/S Ratio?

Elridge Energy Holdings Berhad's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 10%. The latest three year period has also seen an excellent 187% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 29% during the coming year according to the lone analyst following the company. Meanwhile, the broader industry is forecast to contract by 1.1%, which would indicate the company is doing very well.

With this information, we can see why Elridge Energy Holdings Berhad is trading at such a high P/S compared to the industry. Right now, investors are willing to pay more for a stock that is shaping up to buck the trend of the broader industry going backwards.

What We Can Learn From Elridge Energy Holdings Berhad's P/S?

The strong share price surge has lead to Elridge Energy Holdings Berhad's P/S soaring as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We can see that Elridge Energy Holdings Berhad maintains its high P/S on the strength of its forecast growth potentially beating a struggling industry, as expected. Outperforming the industry in this manner looks to have provided investors with a bit of confidence that the future will be bright, bolstering the P/S. We still remain cautious about the company's ability to keep swimming against the current of the broader industry turmoil. Assuming the company's outlook remains unchanged, the share price is likely to be supported by prospective buyers.

Before you settle on your opinion, we've discovered 1 warning sign for Elridge Energy Holdings Berhad that you should be aware of.

If you're unsure about the strength of Elridge Energy Holdings Berhad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Elridge Energy Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:ELRIDGE

Elridge Energy Holdings Berhad

An investment holding company, engages in the manufacture and trading of biomass fuel products in Malaysia, Singapore, Indonesia, Japan, and Thailand.

Exceptional growth potential with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026