- Malaysia

- /

- Energy Services

- /

- KLSE:BARAKAH

Barakah Offshore Petroleum Berhad's (KLSE:BARAKAH) P/S Is On The Mark

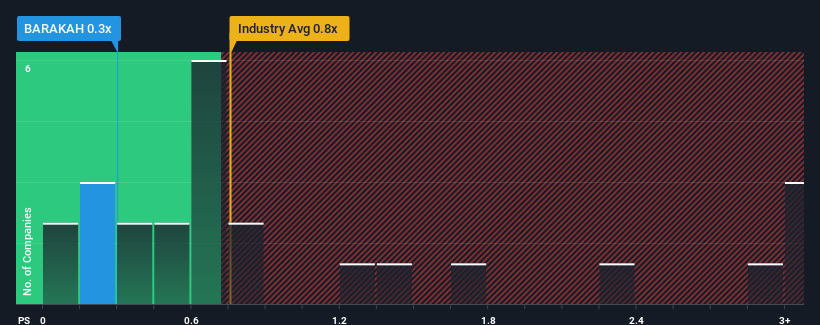

There wouldn't be many who think Barakah Offshore Petroleum Berhad's (KLSE:BARAKAH) price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S for the Energy Services industry in Malaysia is similar at about 0.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Barakah Offshore Petroleum Berhad

What Does Barakah Offshore Petroleum Berhad's Recent Performance Look Like?

We'd have to say that with no tangible growth over the last year, Barakah Offshore Petroleum Berhad's revenue has been unimpressive. One possibility is that the P/S is moderate because investors think this benign revenue growth rate might not be enough to outperform the broader industry in the near future. Those who are bullish on Barakah Offshore Petroleum Berhad will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Barakah Offshore Petroleum Berhad will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Barakah Offshore Petroleum Berhad would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with revenue down 21% overall from three years ago. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

It turns out the industry is also predicted to shrink 5.9% in the next 12 months, mirroring the company's downward momentum based on recent medium-term annualised revenue results.

With this information, it might not be too hard to see why Barakah Offshore Petroleum Berhad is trading at a fairly similar P/S in comparison. However, shrinking revenues are unlikely to lead to a stable P/S long-term, which could set up shareholders for future disappointment regardless. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As expected, our analysis of Barakah Offshore Petroleum Berhad confirms that the company's contraction in revenue over the past three-year years is a major contributor to its industry-matching P/S, given the industry is set to decline in a similar fashion. Right now shareholders are comfortable with the P/S as they seem confident future revenue won't throw up any further unpleasant surprises. Although, we are concerned whether the company's performance will worsen relative to other industry players under these tough industry conditions. In the meantime, unless the company's relative performance changes, the share price should find support at these levels.

You always need to take note of risks, for example - Barakah Offshore Petroleum Berhad has 3 warning signs we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Barakah Offshore Petroleum Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:BARAKAH

Barakah Offshore Petroleum Berhad

An investment holding company, engages in the provision of offshore and onshore services for oil and gas industry in Malaysia and Brunei Darussalam.

Adequate balance sheet slight.