- Malaysia

- /

- Energy Services

- /

- KLSE:ALAM

It's Probably Less Likely That Alam Maritim Resources Berhad's (KLSE:ALAM) CEO Will See A Huge Pay Rise This Year

In the past three years, the share price of Alam Maritim Resources Berhad (KLSE:ALAM) has struggled to grow and now shareholders are sitting on a loss. What is concerning is that despite positive EPS growth, the share price has not tracked the trend in fundamentals. The AGM coming up on the 29 June 2021 could be an opportunity for shareholders to bring these concerns to the board's attention. They could also try to influence management and firm direction through voting on resolutions such as executive remuneration and other company matters. We think shareholders might be reluctant to increase compensation for the CEO at the moment, according to our analysis below.

See our latest analysis for Alam Maritim Resources Berhad

Comparing Alam Maritim Resources Berhad's CEO Compensation With the industry

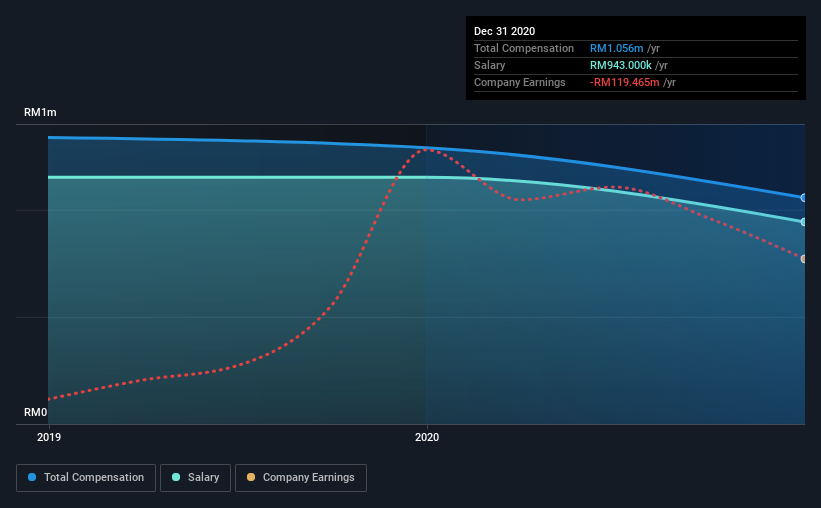

According to our data, Alam Maritim Resources Berhad has a market capitalization of RM108m, and paid its CEO total annual compensation worth RM1.1m over the year to December 2020. Notably, that's a decrease of 18% over the year before. Notably, the salary which is RM943.0k, represents most of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations under RM831m, the reported median total CEO compensation was RM1.4m. This suggests that Alam Maritim Resources Berhad remunerates its CEO largely in line with the industry average.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | RM943k | RM1.2m | 89% |

| Other | RM113k | RM138k | 11% |

| Total Compensation | RM1.1m | RM1.3m | 100% |

Talking in terms of the industry, salary represented approximately 79% of total compensation out of all the companies we analyzed, while other remuneration made up 21% of the pie. Alam Maritim Resources Berhad pays out 89% of remuneration in the form of a salary, significantly higher than the industry average. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Alam Maritim Resources Berhad's Growth

Over the past three years, Alam Maritim Resources Berhad has seen its earnings per share (EPS) grow by 24% per year. It saw its revenue drop 17% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's always a tough situation when revenues are not growing, but ultimately profits are more important. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Alam Maritim Resources Berhad Been A Good Investment?

The return of -42% over three years would not have pleased Alam Maritim Resources Berhad shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Shareholders have not seen their shares grow in value, rather they have seen their shares decline. The stock's movement is disjointed with the company's earnings growth, which ideally should move in the same direction. Shareholders would probably be keen to find out what are the other factors could be weighing down the stock. These concerns should be addressed at the upcoming AGM, where shareholders can question the board and evaluate if their judgement and decision making is still in line with their expectations.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We did our research and identified 4 warning signs (and 1 which makes us a bit uncomfortable) in Alam Maritim Resources Berhad we think you should know about.

Switching gears from Alam Maritim Resources Berhad, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:ALAM

Alam Maritim Resources Berhad

An investment holding company, provides services to the oil and gas industry in Malaysia.

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026