- Malaysia

- /

- Hospitality

- /

- KLSE:EXSIMHB

Pan Malaysia Holdings Berhad (KLSE:PMHLDG) Is Carrying A Fair Bit Of Debt

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Pan Malaysia Holdings Berhad (KLSE:PMHLDG) makes use of debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Pan Malaysia Holdings Berhad

How Much Debt Does Pan Malaysia Holdings Berhad Carry?

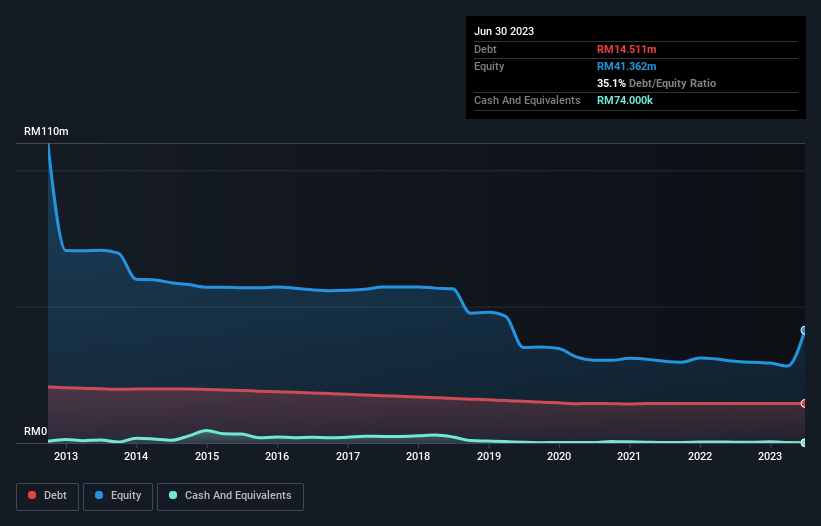

The chart below, which you can click on for greater detail, shows that Pan Malaysia Holdings Berhad had RM14.5m in debt in June 2023; about the same as the year before. Net debt is about the same, since the it doesn't have much cash.

How Healthy Is Pan Malaysia Holdings Berhad's Balance Sheet?

The latest balance sheet data shows that Pan Malaysia Holdings Berhad had liabilities of RM9.40m due within a year, and liabilities of RM17.8m falling due after that. Offsetting these obligations, it had cash of RM74.0k as well as receivables valued at RM32.4m due within 12 months. So it can boast RM5.24m more liquid assets than total liabilities.

This surplus suggests that Pan Malaysia Holdings Berhad has a conservative balance sheet, and could probably eliminate its debt without much difficulty. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Pan Malaysia Holdings Berhad will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Pan Malaysia Holdings Berhad wasn't profitable at an EBIT level, but managed to grow its revenue by 28%, to RM5.3m. Shareholders probably have their fingers crossed that it can grow its way to profits.

Caveat Emptor

Even though Pan Malaysia Holdings Berhad managed to grow its top line quite deftly, the cold hard truth is that it is losing money on the EBIT line. Indeed, it lost RM157k at the EBIT level. On a more positive note, the company does have liquid assets, so it has a bit of time to improve its operations before the debt becomes an acute problem. Still, we'd be more encouraged to study the business in depth if it already had some free cash flow. So it seems too risky for our taste. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 4 warning signs with Pan Malaysia Holdings Berhad (at least 2 which are potentially serious) , and understanding them should be part of your investment process.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're here to simplify it.

Discover if Exsim Hospitality Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:EXSIMHB

Exsim Hospitality Berhad

An investment holding company, engages in the hotel business in Malaysia.

Adequate balance sheet very low.

Market Insights

Community Narratives