- Malaysia

- /

- Hospitality

- /

- KLSE:EXSIMHB

Investors Who Bought Pan Malaysia Holdings Berhad (KLSE:PMHLDG) Shares Five Years Ago Are Now Down 71%

It is doubtless a positive to see that the Pan Malaysia Holdings Berhad (KLSE:PMHLDG) share price has gained some 50% in the last three months. But that doesn't change the fact that the returns over the last half decade have been stomach churning. Indeed, the share price is down a whopping 71% in that time. It's true that the recent bounce could signal the company is turning over a new leaf, but we are not so sure. The fundamental business performance will ultimately determine if the turnaround can be sustained.

Check out our latest analysis for Pan Malaysia Holdings Berhad

Pan Malaysia Holdings Berhad isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over half a decade Pan Malaysia Holdings Berhad reduced its trailing twelve month revenue by 2.0% for each year. While far from catastrophic that is not good. If a business loses money, you want it to grow, so no surprises that the share price has dropped 22% each year in that time. We're generally averse to companies with declining revenues, but we're not alone in that. Fear of becoming a 'bagholder' may be keeping people away from this stock.

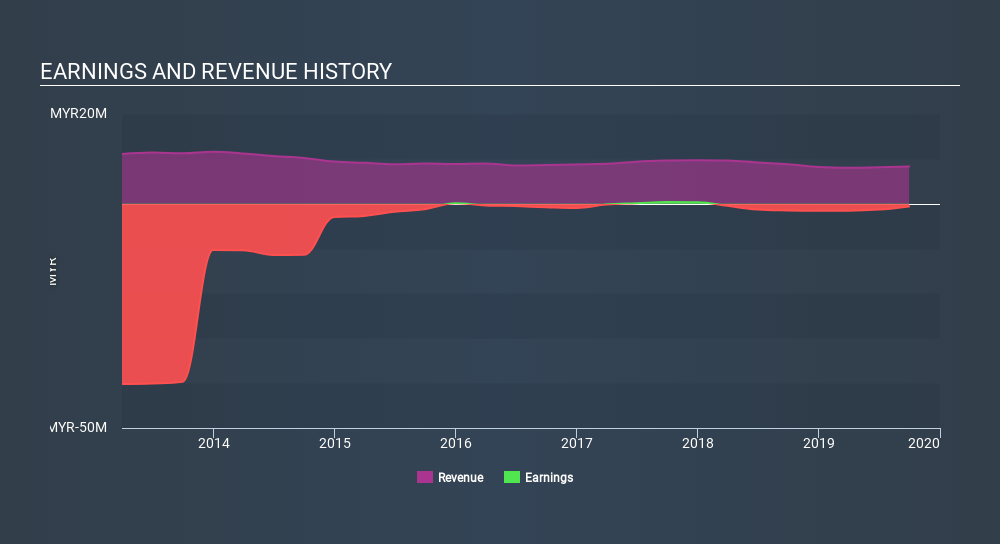

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's nice to see that Pan Malaysia Holdings Berhad shareholders have received a total shareholder return of 62% over the last year. There's no doubt those recent returns are much better than the TSR loss of 22% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 4 warning signs we've spotted with Pan Malaysia Holdings Berhad .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About KLSE:EXSIMHB

Exsim Hospitality Berhad

An investment holding company, operates in the hospitality industry in Malaysia.

Low with imperfect balance sheet.

Market Insights

Community Narratives