- Malaysia

- /

- Hospitality

- /

- KLSE:OWG

Only World Group Holdings Berhad (KLSE:OWG) May Have Run Too Fast Too Soon With Recent 27% Price Plummet

Only World Group Holdings Berhad (KLSE:OWG) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 42% share price drop.

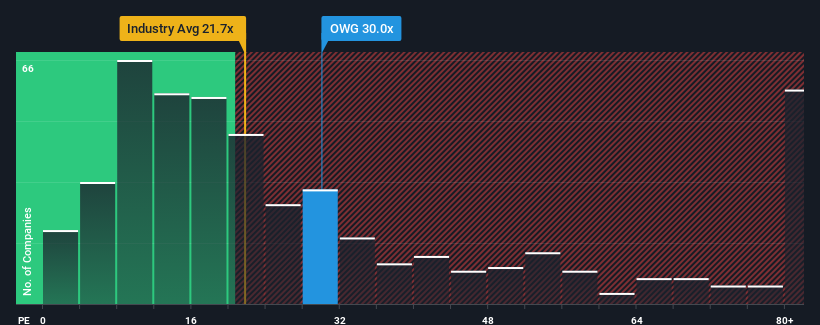

Although its price has dipped substantially, Only World Group Holdings Berhad's price-to-earnings (or "P/E") ratio of 30x might still make it look like a strong sell right now compared to the market in Malaysia, where around half of the companies have P/E ratios below 15x and even P/E's below 9x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

As an illustration, earnings have deteriorated at Only World Group Holdings Berhad over the last year, which is not ideal at all. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Only World Group Holdings Berhad

Is There Enough Growth For Only World Group Holdings Berhad?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Only World Group Holdings Berhad's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 65%. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Comparing that to the market, which is predicted to deliver 17% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

With this information, we find it concerning that Only World Group Holdings Berhad is trading at a P/E higher than the market. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Final Word

Even after such a strong price drop, Only World Group Holdings Berhad's P/E still exceeds the rest of the market significantly. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Only World Group Holdings Berhad revealed its three-year earnings trends aren't impacting its high P/E anywhere near as much as we would have predicted, given they look worse than current market expectations. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Only World Group Holdings Berhad, and understanding these should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:OWG

Only World Group Holdings Berhad

An investment holding company, operates and manages entertainment, hospitality, and leisure related brands found in various resorts and shopping malls in Malaysia.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives