- Malaysia

- /

- Hospitality

- /

- KLSE:BORNOIL

Borneo Oil Berhad's (KLSE:BORNOIL) P/S Is Still On The Mark Following 100% Share Price Bounce

Borneo Oil Berhad (KLSE:BORNOIL) shareholders would be excited to see that the share price has had a great month, posting a 100% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 100%.

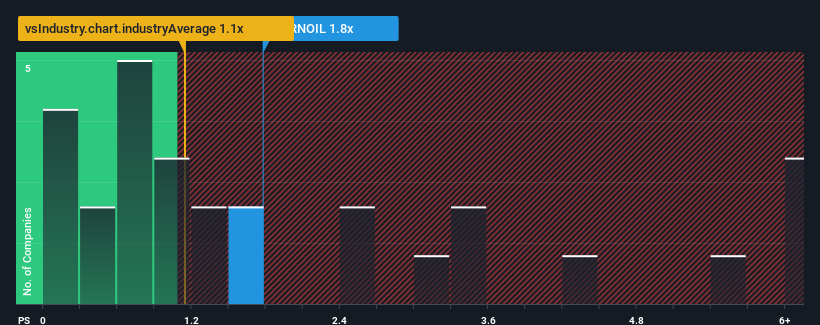

Since its price has surged higher, given close to half the companies operating in Malaysia's Hospitality industry have price-to-sales ratios (or "P/S") below 1.1x, you may consider Borneo Oil Berhad as a stock to potentially avoid with its 1.8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Borneo Oil Berhad

What Does Borneo Oil Berhad's Recent Performance Look Like?

For example, consider that Borneo Oil Berhad's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. If not, then existing shareholders may be quite nervous about the viability of the share price.

Although there are no analyst estimates available for Borneo Oil Berhad, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Borneo Oil Berhad?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Borneo Oil Berhad's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 3.6%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 33% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 8.1%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's understandable that Borneo Oil Berhad's P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Final Word

The large bounce in Borneo Oil Berhad's shares has lifted the company's P/S handsomely. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Borneo Oil Berhad revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

You should always think about risks. Case in point, we've spotted 4 warning signs for Borneo Oil Berhad you should be aware of, and 2 of them are a bit concerning.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Borneo Oil Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:BORNOIL

Borneo Oil Berhad

An investment holding company, operates and franchises fast food restaurants in Malaysia and Australia.

Slight with imperfect balance sheet.

Market Insights

Community Narratives