- Malaysia

- /

- Food and Staples Retail

- /

- KLSE:KTC

Is Kim Teck Cheong Consolidated Berhad (KLSE:KTC) Using Too Much Debt?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Kim Teck Cheong Consolidated Berhad (KLSE:KTC) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

What Is Kim Teck Cheong Consolidated Berhad's Debt?

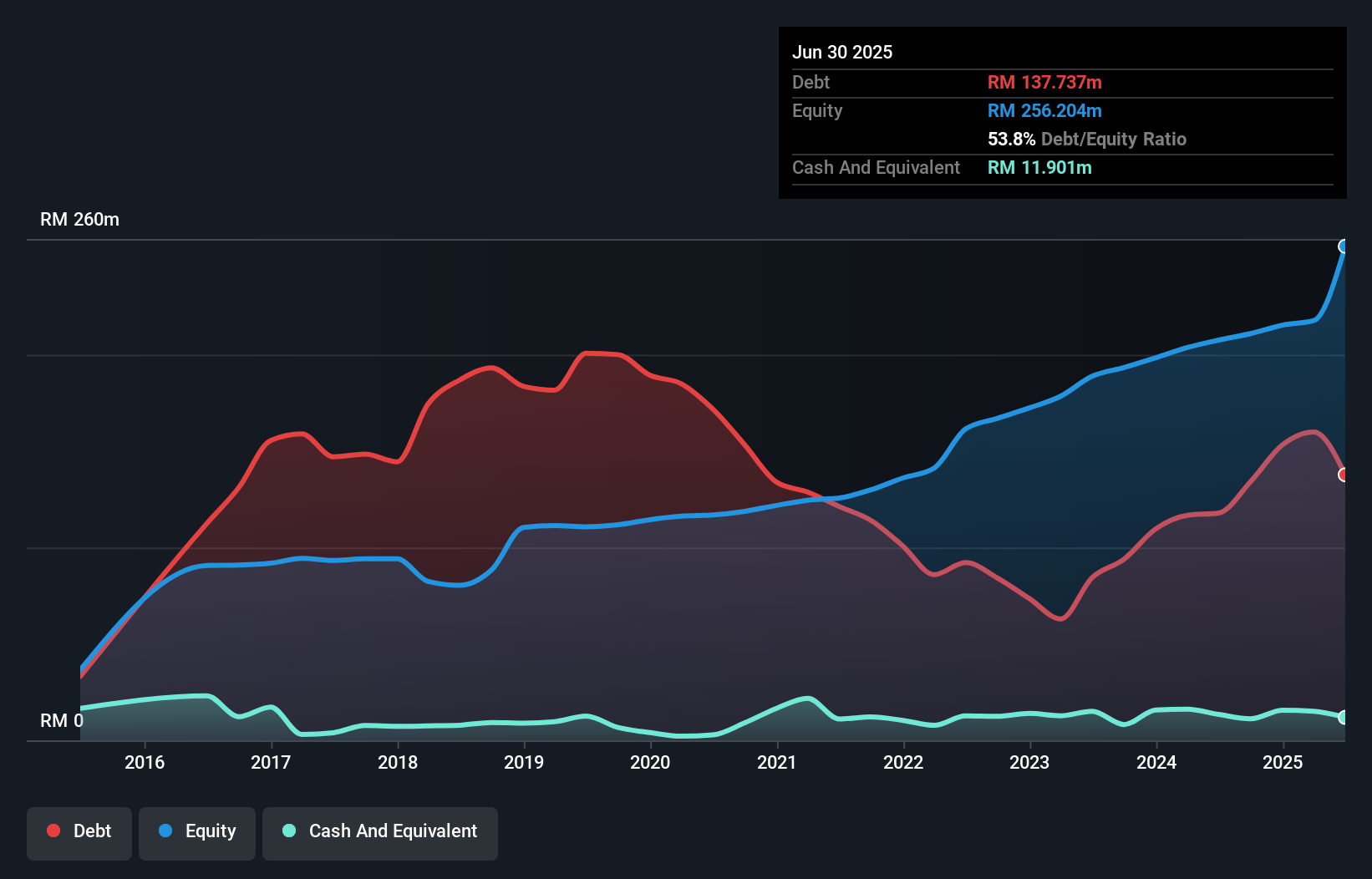

The image below, which you can click on for greater detail, shows that at June 2025 Kim Teck Cheong Consolidated Berhad had debt of RM137.7m, up from RM117.9m in one year. However, it does have RM11.9m in cash offsetting this, leading to net debt of about RM125.8m.

How Strong Is Kim Teck Cheong Consolidated Berhad's Balance Sheet?

According to the last reported balance sheet, Kim Teck Cheong Consolidated Berhad had liabilities of RM202.3m due within 12 months, and liabilities of RM47.0m due beyond 12 months. On the other hand, it had cash of RM11.9m and RM139.6m worth of receivables due within a year. So its liabilities total RM97.8m more than the combination of its cash and short-term receivables.

This is a mountain of leverage relative to its market capitalization of RM115.9m. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

Check out our latest analysis for Kim Teck Cheong Consolidated Berhad

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Kim Teck Cheong Consolidated Berhad has a debt to EBITDA ratio of 3.1 and its EBIT covered its interest expense 5.5 times. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. One way Kim Teck Cheong Consolidated Berhad could vanquish its debt would be if it stops borrowing more but continues to grow EBIT at around 15%, as it did over the last year. When analysing debt levels, the balance sheet is the obvious place to start. But it is Kim Teck Cheong Consolidated Berhad's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Kim Teck Cheong Consolidated Berhad burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

Mulling over Kim Teck Cheong Consolidated Berhad's attempt at converting EBIT to free cash flow, we're certainly not enthusiastic. But at least it's pretty decent at growing its EBIT; that's encouraging. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making Kim Teck Cheong Consolidated Berhad stock a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 2 warning signs for Kim Teck Cheong Consolidated Berhad that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Kim Teck Cheong Consolidated Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:KTC

Kim Teck Cheong Consolidated Berhad

Engages in distribution and warehousing of consumer packaged goods in East Malaysia and Brunei.

Adequate balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026