- Malaysia

- /

- Construction

- /

- KLSE:SINARAN

Shareholders May Not Be So Generous With Sinaran Advance Group Berhad's (KLSE:SINARAN) CEO Compensation And Here's Why

In the past three years, the share price of Sinaran Advance Group Berhad (KLSE:SINARAN) has struggled to grow and now shareholders are sitting on a loss. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. These are some of the concerns that shareholders may want to bring up at the next AGM held on 24 September 2021. They could also influence management through voting on resolutions such as executive remuneration. We discuss below why we think shareholders should be cautious of approving a raise for the CEO at the moment.

See our latest analysis for Sinaran Advance Group Berhad

Comparing Sinaran Advance Group Berhad's CEO Compensation With the industry

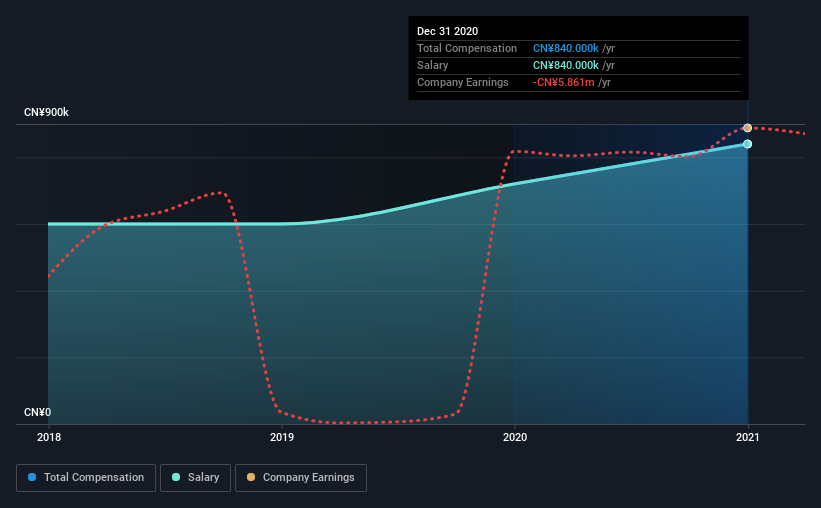

At the time of writing, our data shows that Sinaran Advance Group Berhad has a market capitalization of RM56m, and reported total annual CEO compensation of CN¥840k for the year to December 2020. We note that's an increase of 17% above last year. It is worth noting that the CEO compensation consists entirely of the salary, worth CN¥840k.

On comparing similar-sized companies in the industry with market capitalizations below RM832m, we found that the median total CEO compensation was CN¥472k. Accordingly, our analysis reveals that Sinaran Advance Group Berhad pays JianPing Ding north of the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CN¥840k | CN¥720k | 100% |

| Other | - | - | - |

| Total Compensation | CN¥840k | CN¥720k | 100% |

Speaking on an industry level, nearly 80% of total compensation represents salary, while the remainder of 20% is other remuneration. On a company level, Sinaran Advance Group Berhad prefers to reward its CEO through a salary, opting not to pay JianPing Ding through non-salary benefits. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Sinaran Advance Group Berhad's Growth

Sinaran Advance Group Berhad's earnings per share (EPS) grew 48% per year over the last three years. It saw its revenue drop 37% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. While it would be good to see revenue growth, profits matter more in the end. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Sinaran Advance Group Berhad Been A Good Investment?

Since shareholders would have lost about 27% over three years, some Sinaran Advance Group Berhad investors would surely be feeling negative emotions. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Sinaran Advance Group Berhad pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. The fact that shareholders are sitting on a loss on the value of their shares in the past few years is certainly disconcerting. The stock's movement is disjointed with the company's earnings growth, which ideally should move in the same direction. If there are some unknown variables that are influencing the stock's price, surely shareholders would have some concerns. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 2 warning signs for Sinaran Advance Group Berhad you should be aware of, and 1 of them shouldn't be ignored.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:SINARAN

Sinaran Advance Group Berhad

An investment holding company, engages in construction and related activities in Malaysia.

Excellent balance sheet with moderate risk.

Market Insights

Community Narratives