Why We Think Niche Capital Emas Holdings Berhad's (KLSE:NICE) CEO Compensation Is Not Excessive At All

Key Insights

- Niche Capital Emas Holdings Berhad will host its Annual General Meeting on 27th of November

- Salary of RM720.0k is part of CEO Julian Foo's total remuneration

- The overall pay is comparable to the industry average

- Niche Capital Emas Holdings Berhad's total shareholder return over the past three years was 23% while its EPS was down 35% over the past three years

Despite Niche Capital Emas Holdings Berhad's (KLSE:NICE) share price growing positively in the past few years, the per-share earnings growth has not grown to investors' expectations, suggesting that there could be other factors at play driving the share price. Some of these issues will occupy shareholders' minds as the AGM rolls around on 27th of November. It would also be an opportunity for them to influence management through exercising their voting power on company resolutions, including CEO and executive remuneration, which could impact on firm performance in the future. From the data that we gathered, we think that shareholders should hold off on a raise on CEO compensation until performance starts to show some improvement.

See our latest analysis for Niche Capital Emas Holdings Berhad

Comparing Niche Capital Emas Holdings Berhad's CEO Compensation With The Industry

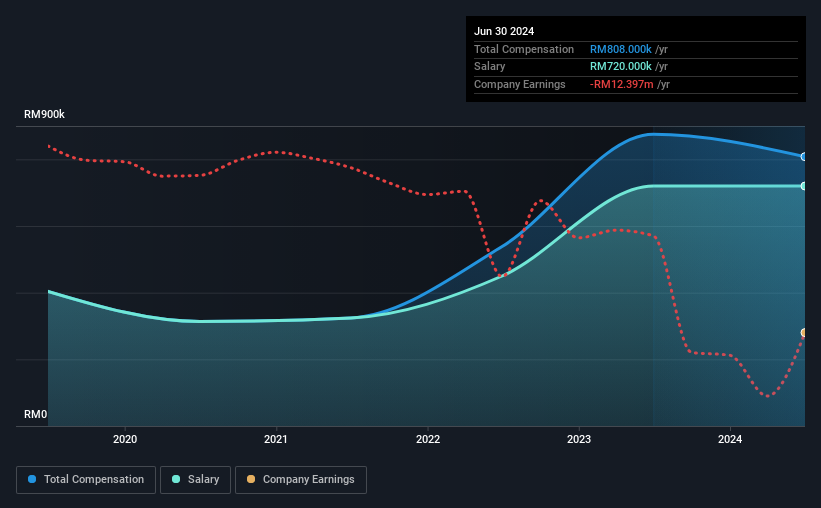

At the time of writing, our data shows that Niche Capital Emas Holdings Berhad has a market capitalization of RM267m, and reported total annual CEO compensation of RM808k for the year to June 2024. That's slightly lower by 7.7% over the previous year. We note that the salary portion, which stands at RM720.0k constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the Malaysia Luxury industry with market capitalizations under RM894m, the reported median total CEO compensation was RM770k. This suggests that Niche Capital Emas Holdings Berhad remunerates its CEO largely in line with the industry average. Furthermore, Julian Foo directly owns RM39m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | RM720k | RM720k | 89% |

| Other | RM88k | RM155k | 11% |

| Total Compensation | RM808k | RM875k | 100% |

Speaking on an industry level, nearly 72% of total compensation represents salary, while the remainder of 28% is other remuneration. It's interesting to note that Niche Capital Emas Holdings Berhad pays out a greater portion of remuneration through salary, compared to the industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Niche Capital Emas Holdings Berhad's Growth Numbers

Niche Capital Emas Holdings Berhad has reduced its earnings per share by 35% a year over the last three years. It saw its revenue drop 25% over the last year.

The decline in EPS is a bit concerning. This is compounded by the fact revenue is actually down on last year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Niche Capital Emas Holdings Berhad Been A Good Investment?

Niche Capital Emas Holdings Berhad has generated a total shareholder return of 23% over three years, so most shareholders would be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

While it's true that shareholders have owned decent returns, it's hard to overlook the lack of earnings growth and this makes us question whether these returns will continue. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We identified 6 warning signs for Niche Capital Emas Holdings Berhad (2 are concerning!) that you should be aware of before investing here.

Important note: Niche Capital Emas Holdings Berhad is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Niche Capital Emas Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:NICE

Niche Capital Emas Holdings Berhad

An investment holding company, engages in the construction and services, trading, and mining businesses in Malaysia.

Moderate risk with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A buy recommendation

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026