- Malaysia

- /

- Professional Services

- /

- KLSE:ZETRIX

These 4 Measures Indicate That My E.G. Services Berhad (KLSE:MYEG) Is Using Debt Reasonably Well

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies My E.G. Services Berhad (KLSE:MYEG) makes use of debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for My E.G. Services Berhad

How Much Debt Does My E.G. Services Berhad Carry?

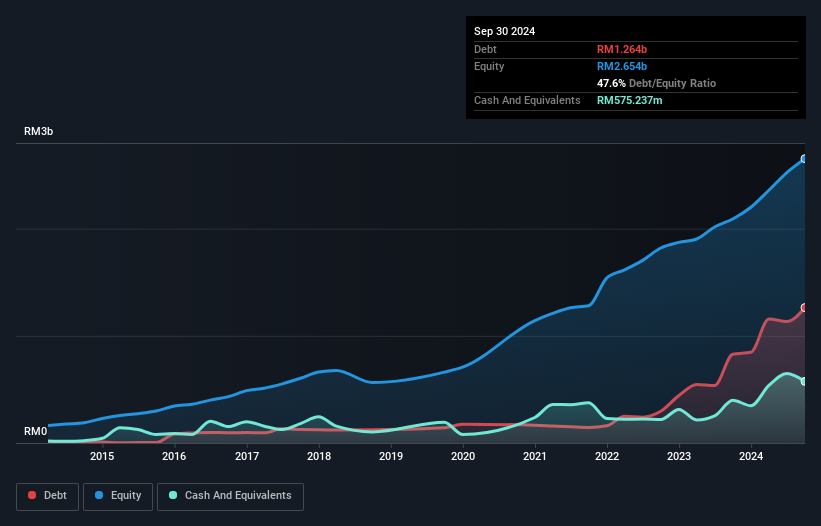

As you can see below, at the end of September 2024, My E.G. Services Berhad had RM1.26b of debt, up from RM828.8m a year ago. Click the image for more detail. On the flip side, it has RM575.2m in cash leading to net debt of about RM688.5m.

How Healthy Is My E.G. Services Berhad's Balance Sheet?

We can see from the most recent balance sheet that My E.G. Services Berhad had liabilities of RM157.6m falling due within a year, and liabilities of RM1.22b due beyond that. Offsetting this, it had RM575.2m in cash and RM655.4m in receivables that were due within 12 months. So it has liabilities totalling RM145.6m more than its cash and near-term receivables, combined.

This state of affairs indicates that My E.G. Services Berhad's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the RM7.42b company is short on cash, but still worth keeping an eye on the balance sheet.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

My E.G. Services Berhad's net debt is only 0.94 times its EBITDA. And its EBIT covers its interest expense a whopping 12.2 times over. So we're pretty relaxed about its super-conservative use of debt. In addition to that, we're happy to report that My E.G. Services Berhad has boosted its EBIT by 55%, thus reducing the spectre of future debt repayments. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine My E.G. Services Berhad's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, My E.G. Services Berhad saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Happily, My E.G. Services Berhad's impressive interest cover implies it has the upper hand on its debt. But the stark truth is that we are concerned by its conversion of EBIT to free cash flow. All these things considered, it appears that My E.G. Services Berhad can comfortably handle its current debt levels. Of course, while this leverage can enhance returns on equity, it does bring more risk, so it's worth keeping an eye on this one. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 1 warning sign for My E.G. Services Berhad that you should be aware of before investing here.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Zetrix AI Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:ZETRIX

Zetrix AI Berhad

An investment holding company, develops and implements electronic government services project, and provides other related services in Malaysia and internationally.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.