- Malaysia

- /

- Commercial Services

- /

- KLSE:MCLEAN

Shareholders Shouldn’t Be Too Comfortable With MClean Technologies Berhad's (KLSE:MCLEAN) Strong Earnings

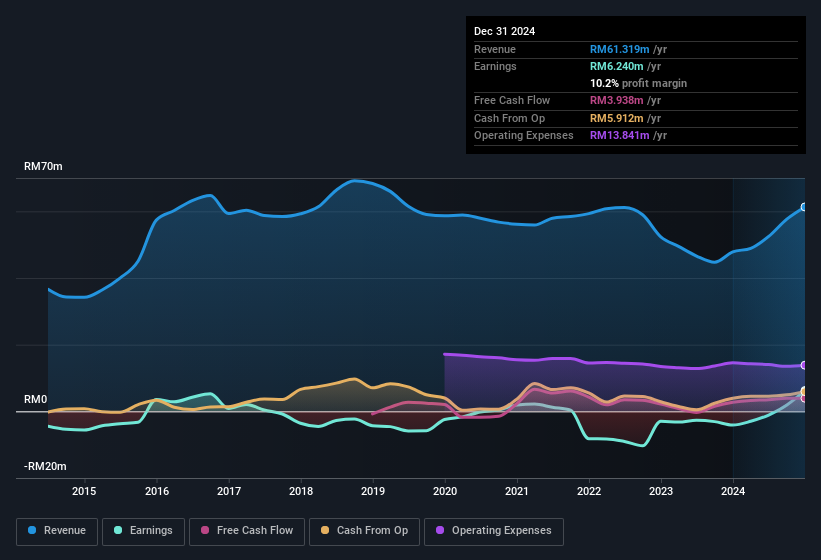

Even though MClean Technologies Berhad (KLSE:MCLEAN) posted strong earnings recently, the stock hasn't reacted in a large way. We decided to have a deeper look, and we believe that investors might be worried about several concerning factors that we found.

We've discovered 3 warning signs about MClean Technologies Berhad. View them for free.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. In fact, MClean Technologies Berhad increased the number of shares on issue by 25% over the last twelve months by issuing new shares. As a result, its net income is now split between a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. Check out MClean Technologies Berhad's historical EPS growth by clicking on this link.

A Look At The Impact Of MClean Technologies Berhad's Dilution On Its Earnings Per Share (EPS)

MClean Technologies Berhad was losing money three years ago. Zooming in to the last year, we still can't talk about growth rates coherently, since it made a loss last year. What we do know is that while it's great to see a profit over the last twelve months, that profit would have been better, on a per share basis, if the company hadn't needed to issue shares. Therefore, one can observe that the dilution is having a fairly profound effect on shareholder returns.

If MClean Technologies Berhad's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of MClean Technologies Berhad.

How Do Unusual Items Influence Profit?

Alongside that dilution, it's also important to note that MClean Technologies Berhad's profit was boosted by unusual items worth RM4.1m in the last twelve months. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And, after all, that's exactly what the accounting terminology implies. MClean Technologies Berhad had a rather significant contribution from unusual items relative to its profit to December 2024. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Our Take On MClean Technologies Berhad's Profit Performance

In its last report MClean Technologies Berhad benefitted from unusual items which boosted its profit, which could make the profit seem better than it really is on a sustainable basis. On top of that, the dilution means that its earnings per share performance is worse than its profit performance. For the reasons mentioned above, we think that a perfunctory glance at MClean Technologies Berhad's statutory profits might make it look better than it really is on an underlying level. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. While conducting our analysis, we found that MClean Technologies Berhad has 3 warning signs and it would be unwise to ignore these bad boys.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:MCLEAN

MClean Technologies Berhad

An investment holding company, provides precision cleaning, surface treatment, and cleanroom packaging services for hard disk drives, consumer electronics, and oil and gas industries.

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026