- Malaysia

- /

- Commercial Services

- /

- KLSE:JADI

We Think Jadi Imaging Holdings Berhad (KLSE:JADI) Has A Fair Chunk Of Debt

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Jadi Imaging Holdings Berhad (KLSE:JADI) does carry debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Jadi Imaging Holdings Berhad

What Is Jadi Imaging Holdings Berhad's Net Debt?

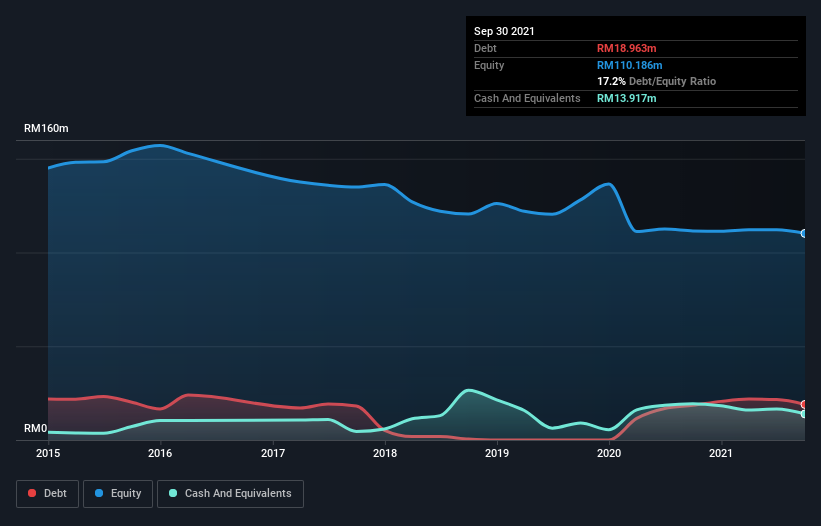

As you can see below, Jadi Imaging Holdings Berhad had RM19.0m of debt, at September 2021, which is about the same as the year before. You can click the chart for greater detail. However, because it has a cash reserve of RM13.9m, its net debt is less, at about RM5.05m.

A Look At Jadi Imaging Holdings Berhad's Liabilities

According to the last reported balance sheet, Jadi Imaging Holdings Berhad had liabilities of RM10.5m due within 12 months, and liabilities of RM24.3m due beyond 12 months. On the other hand, it had cash of RM13.9m and RM10.7m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by RM10.2m.

Of course, Jadi Imaging Holdings Berhad has a market capitalization of RM96.9m, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Jadi Imaging Holdings Berhad will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Jadi Imaging Holdings Berhad wasn't profitable at an EBIT level, but managed to grow its revenue by 8.6%, to RM43m. We usually like to see faster growth from unprofitable companies, but each to their own.

Caveat Emptor

Over the last twelve months Jadi Imaging Holdings Berhad produced an earnings before interest and tax (EBIT) loss. To be specific the EBIT loss came in at RM2.3m. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. However, it doesn't help that it burned through RM4.4m of cash over the last year. So suffice it to say we do consider the stock to be risky. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 4 warning signs for Jadi Imaging Holdings Berhad (of which 1 can't be ignored!) you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:JADI

Jadi Imaging Holdings Berhad

An investment holding company, engages in the retailing of consumer products through e-commerce activities in Malaysia, China, the United Kingdom, the United States of America, Egypt, and internationally.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

GE Vernova revenue will grow by 13% with a future PE of 64.7x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026