- Malaysia

- /

- Commercial Services

- /

- KLSE:CWG

There's Reason For Concern Over CWG Holdings Berhad's (KLSE:CWG) Massive 27% Price Jump

CWG Holdings Berhad (KLSE:CWG) shareholders have had their patience rewarded with a 27% share price jump in the last month. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

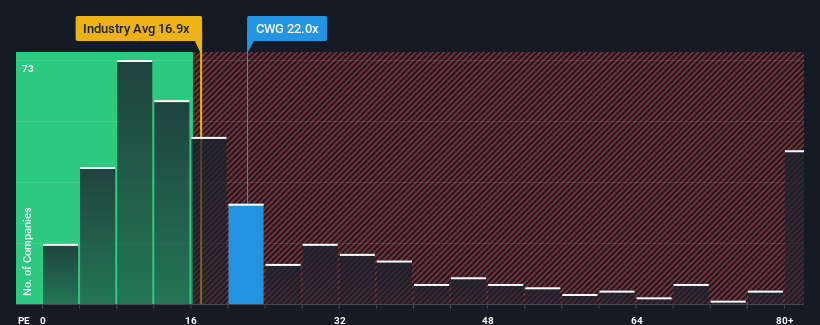

Following the firm bounce in price, given around half the companies in Malaysia have price-to-earnings ratios (or "P/E's") below 18x, you may consider CWG Holdings Berhad as a stock to potentially avoid with its 22x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

As an illustration, earnings have deteriorated at CWG Holdings Berhad over the last year, which is not ideal at all. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for CWG Holdings Berhad

Is There Enough Growth For CWG Holdings Berhad?

There's an inherent assumption that a company should outperform the market for P/E ratios like CWG Holdings Berhad's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 55%. Even so, admirably EPS has lifted 57% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to grow by 18% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's alarming that CWG Holdings Berhad's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

What We Can Learn From CWG Holdings Berhad's P/E?

The large bounce in CWG Holdings Berhad's shares has lifted the company's P/E to a fairly high level. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that CWG Holdings Berhad currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 3 warning signs for CWG Holdings Berhad that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KLSE:CWG

CWG Holdings Berhad

An investment holding company, engages in the manufacture and sale of paper-based stationery and printing materials in Malaysia, Africa, the United States, Europe, Oceania, and rest of Asia.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026