- Malaysia

- /

- Commercial Services

- /

- KLSE:CABNET

Investors Give Cabnet Holdings Berhad (KLSE:CABNET) Shares A 27% Hiding

Unfortunately for some shareholders, the Cabnet Holdings Berhad (KLSE:CABNET) share price has dived 27% in the last thirty days, prolonging recent pain. Still, a bad month hasn't completely ruined the past year with the stock gaining 56%, which is great even in a bull market.

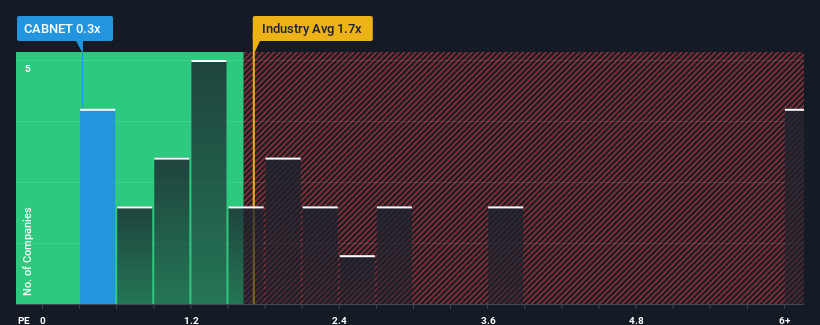

In spite of the heavy fall in price, when close to half the companies operating in Malaysia's Commercial Services industry have price-to-sales ratios (or "P/S") above 1.7x, you may still consider Cabnet Holdings Berhad as an enticing stock to check out with its 0.3x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Cabnet Holdings Berhad

What Does Cabnet Holdings Berhad's P/S Mean For Shareholders?

Recent times have been quite advantageous for Cabnet Holdings Berhad as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to dwindle, which has kept the P/S suppressed. Those who are bullish on Cabnet Holdings Berhad will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Cabnet Holdings Berhad's earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Cabnet Holdings Berhad's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 140%. This great performance means it was also able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 29% shows it's noticeably more attractive.

With this information, we find it odd that Cabnet Holdings Berhad is trading at a P/S lower than the industry. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Final Word

Cabnet Holdings Berhad's recently weak share price has pulled its P/S back below other Commercial Services companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Cabnet Holdings Berhad revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Cabnet Holdings Berhad (1 doesn't sit too well with us!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Cabnet Holdings Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:CABNET

Cabnet Holdings Berhad

Provides building management solutions, and mechanical and engineering services in Malaysia.

Adequate balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives