David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, WMG Holdings Bhd. (KLSE:WMG) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for WMG Holdings Bhd

How Much Debt Does WMG Holdings Bhd Carry?

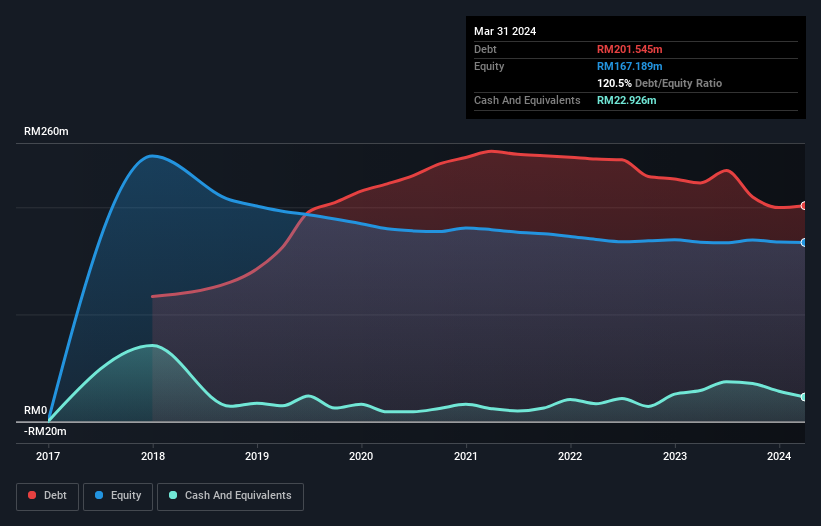

The image below, which you can click on for greater detail, shows that WMG Holdings Bhd had debt of RM201.5m at the end of March 2024, a reduction from RM222.7m over a year. However, it does have RM22.9m in cash offsetting this, leading to net debt of about RM178.6m.

How Healthy Is WMG Holdings Bhd's Balance Sheet?

The latest balance sheet data shows that WMG Holdings Bhd had liabilities of RM166.0m due within a year, and liabilities of RM77.7m falling due after that. On the other hand, it had cash of RM22.9m and RM53.9m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by RM166.9m.

While this might seem like a lot, it is not so bad since WMG Holdings Bhd has a market capitalization of RM351.2m, and so it could probably strengthen its balance sheet by raising capital if it needed to. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

WMG Holdings Bhd shareholders face the double whammy of a high net debt to EBITDA ratio (9.5), and fairly weak interest coverage, since EBIT is just 1.2 times the interest expense. The debt burden here is substantial. Looking on the bright side, WMG Holdings Bhd boosted its EBIT by a silky 40% in the last year. Like a mother's loving embrace of a newborn that sort of growth builds resilience, putting the company in a stronger position to manage its debt. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since WMG Holdings Bhd will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last two years, WMG Holdings Bhd actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

WMG Holdings Bhd's interest cover was a real negative on this analysis, as was its net debt to EBITDA. But like a ballerina ending on a perfect pirouette, it has not trouble converting EBIT to free cash flow. Considering this range of data points, we think WMG Holdings Bhd is in a good position to manage its debt levels. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for WMG Holdings Bhd (of which 1 is concerning!) you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if WMG Holdings Bhd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KLSE:WMG

WMG Holdings Bhd

An investment holding company, primarily engages in the property development activities in Malaysia.

Excellent balance sheet with acceptable track record.